How to Use Your Profit First End-of-Year Profit Distributions

If you’re a business owner who follows the Profit First system, then along with all the other financial matters this time of year brings, you have another to address. What are you going to do with your Profit Distribution?

What’s a Profit Distribution?

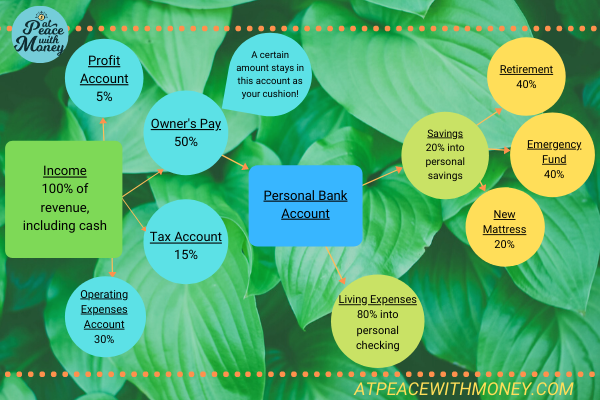

In the second article in my series on money-mapping, I describe Profit Distributions this way:

The profit account accumulates and then is distributed quarterly. Business owners are encouraged to use their Profit Distributions to reward themselves for their hard work. This keeps the owner excited about and invested in the business. It also discourages any tendency to reinvest everything back into the business, or over-save. Rewards can range from a day out to charitable giving, to really anything you want!

Profit Distributions are intended as rewards for the business owner. Think of them as a way to reward yourself for your hard work, by using this bit of extra money in a way that aligns with your values and brings you more of what you want into your life.

Some End-of-Year Ideas

If you stick to the quarterly system, you have two profit distributions bookending the holiday season. One falls at the end of September and the other at the end of December. There are many different ways to put this money to use. Even if your business is small, or just getting started, you can still do a lot with your profit distribution. A couple ideas include:

- Holiday purchases – put the money towards an extra-special gift for someone you love

- Generosity – use the money to donate to a cause you’re passionate about, or consider rewarding your employees with holiday bonuses

- Travel – many folks like to go out of town this time of year. Perhaps you can put your profit distribution towards this!

The key to profit distributions is to use them. Ideally, you check in with your values and make a choice to spend the money on the thing that will most rejuvenate and enrich you. This can be especially important to remember during the holiday season, when things may feel fast-paced and stressful in your business or personal life.

I hope these ideas inspire you to treat yourself well come end-of-year! If you’re interested in more ideas like this, you might like to read my eBook, 9 Secrets to Financial Self-Care! Download it free here.

can still do a lot with your profit distribution. A couple ideas include:

can still do a lot with your profit distribution. A couple ideas include:

The goals that I’m currently leveraging my money system to save up for range from small things to big life events. Last November, I bought a 2016 Rav-4, so one of the goals I’m working on is paying off my car loan. I am also saving up to do a motorcycle tour of New Zealand! Originally I had a target date for this goal, but now things depend on when COVID-19 is no longer an issue, so things are a bit more flexible. You can

The goals that I’m currently leveraging my money system to save up for range from small things to big life events. Last November, I bought a 2016 Rav-4, so one of the goals I’m working on is paying off my car loan. I am also saving up to do a motorcycle tour of New Zealand! Originally I had a target date for this goal, but now things depend on when COVID-19 is no longer an issue, so things are a bit more flexible. You can

with me if you want to know more about how the process might apply to you.

with me if you want to know more about how the process might apply to you.

Using money-mapping and seeing your donation as a percentage of your overall income strengthens the power of your giving. It helps you see exactly how much you can afford to give, and helps you make mindful choices about amount, rather than purely emotional ones. It can be helpful for people who are prone to over-spending and those prone to

Using money-mapping and seeing your donation as a percentage of your overall income strengthens the power of your giving. It helps you see exactly how much you can afford to give, and helps you make mindful choices about amount, rather than purely emotional ones. It can be helpful for people who are prone to over-spending and those prone to

Making a regular habit of checking in with your finances. Make this easy by consolidating your passwords to your different accounts and portals. If you don’t have to go searching for passwords before you begin your checkin, you’re way more likely to actually do it!

Making a regular habit of checking in with your finances. Make this easy by consolidating your passwords to your different accounts and portals. If you don’t have to go searching for passwords before you begin your checkin, you’re way more likely to actually do it!

If you enjoyed this guide, I recommend also checking out

If you enjoyed this guide, I recommend also checking out

The Function of Profit

The Function of Profit