The In-Depth Guide to Mapping Your Money, and How It Can Fortify Your Business, Part II

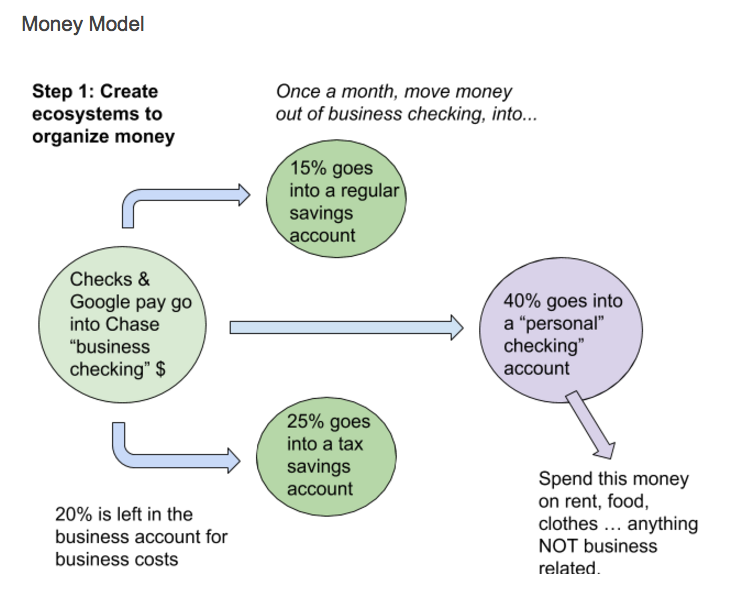

Last week, I talked about money-mapping, why it’s helpful, and how you can get started. Today, we’re going to dive into more money-mapping using the Profit First methodology. Profit First posits its own money system, pictured in the above map. Its goal is to ensure that you as the business owner get paid.

Solopreneur Paycheck

In order to ensure that you actually get paid by your business, you need to portion off a certain percentage of your income, and then designate that for your personal finances. This portioning off is exactly what the Owner’s Pay account is for in the Profit First system. The Profit First system advocates for creating separate accounts for all your different pots of money associated with your business. If you can’t do that or don’t want to, I advise using a spreadsheet. You can use this to keep track of how much money is designated for Profit, Owner’s Pay, Taxes, and Operating Expenses.

So, back to that Owner’s Pay Account. Once you put a percentage of income in it, you then transfer some portion of that to your personal account, which serves as your solopreneur paycheck. When I work with clients, we work to figure out what portion should go into this account. That amount depends on how much the business makes in revenue, and what portion of their personal expenses they want to cover using income from their business. If income in their business varies month to month, we decide on an amount that they transfer to their personal account, leaving the leftovers to act as their cushion during slow months. This way, the business owner receives a steady stream of income, even if their business varies from month to month. This is the solopreneur paycheck.

The Function of Profit

The Function of Profit

Cordoning off funds for operating expenses and taxes may seem practical enough, but the Profit account is what makes the Profit First system unique. The profit account accumulates and then is distributed quarterly. Business owners are encouraged to use their Profit Distributions to reward themselves for their hard work. This keeps the owner excited about and invested in the business. It also discourages any tendency to reinvest everything back into the business, or over-save. Rewards can range from a day out to charitable giving, to really anything you want!

In part three of this series, I’ll discuss what applying this model to your business can look like, and integrate all the info we’ve gone over so far. If you’re enjoying this and would like more, check out part one! You can also head to my services page and schedule a call with me. Money mapping is one of my favorite subjects. Come talk about it with me!

Angela

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.

business with the mindset that you can learn from all your choices can also help alleviate this.

business with the mindset that you can learn from all your choices can also help alleviate this.