How to Reduce Financial Anxiety by Observing Business Patterns

Every business experiences fluctuations in revenue. With good bookkeeping, you start to see the patterns and can begin to leverage them to your advantage. This is a key skill for small business owners. Learning to harness the power of observing business patterns can lead to greater financial security.

Recently I was talking with someone who mentioned that she felt guilty taking a salary from her business, because she hadn’t actually made any money last month. The cyclical nature of her business meant that she made a lot of money during one part of the year, and not very much during the rest. The way I see it, there are several ways to approach a situation like this:

Notice the Pattern

This woman had already taken the first step, which is to notice what revenue patterns are coming up in your business. If you aren’t aware of your own business patterns yet, now’s the time to go back through your records (or get them up to date!) so that you can figure them out. Whether your business is product- or service-based, it is likely subject to fluctuations. It’s likely that these fluctuations are seasonal, or else focused on specific events.

Once you’ve learned where your revenue is coming from, it’s time to make some decisions. To ensure your financial security, it’s best to either focus your business more heavily on your best revenue sources. Sometimes that is either not possible or not preferable – perhaps you want to expand your business beyond a certain season or event. In this case, it’s time to think about how you can adjust your business and move out of that revenue pattern.

Make Adjustments

If you’ve decided you want to alter your business to be less cyclical, it’s time to find ways to avoid sharp drops in revenue during some parts of the year. Oftentimes, this can mean changing your offerings up to be less seasonal/event-focused.

It might also mean broadening the function of your business to more products or services, or more events over a wider range of time. Adjusting your business in these was is also called “diversifying” your business. Here’s an informative read on some ideas for doing this.

Capitalize on Your Patterns

If you are comfortable with the cyclical revenue patterns in your business and are not interested in diversifying, your other option for increasing your financial security is capitalizing on existing patterns. Take a look at what positively impacts your revenue. What are the products are services that do best, and when, where, and why is that happening?

Once you have that information, the next question is, how can you amplify those conditions to bring in more revenue? Can you create variations on a popular product or service? Are there events similar to the one where you always sell out that you can get your business involved in? How can you spend the “downtimes” in your business prepping for the upswings?

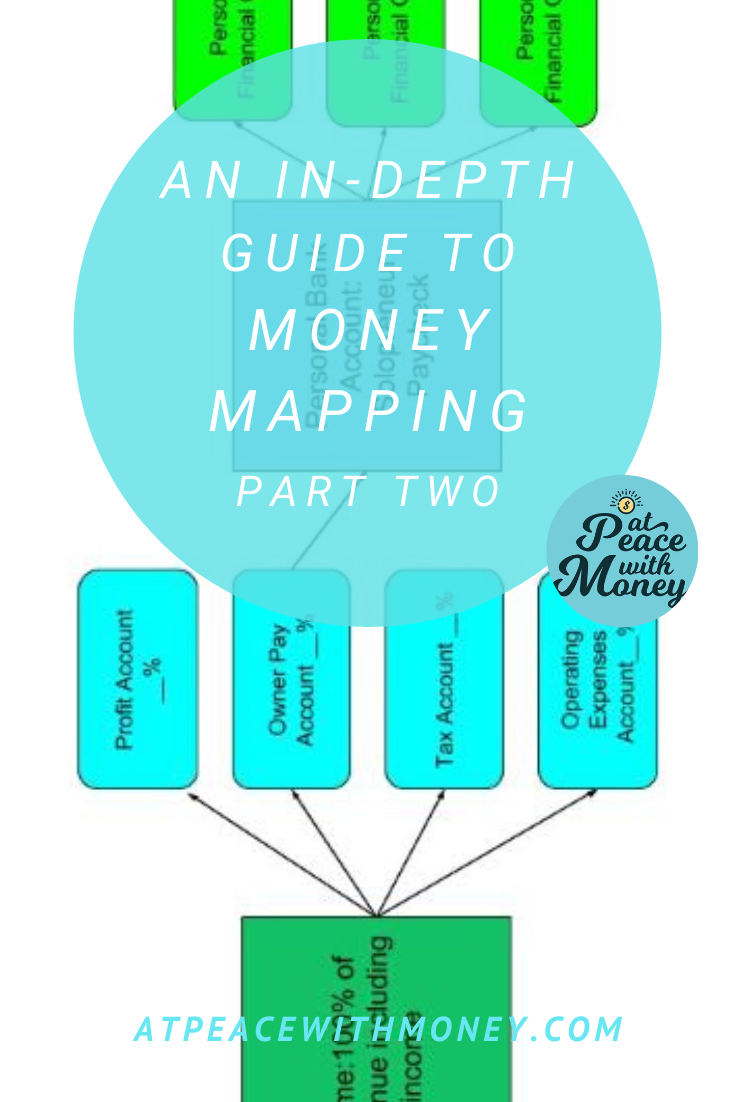

Solopreneur Paycheck

No matter which path you pick, creating a Solopreneur Paycheck for yourself will do wonders to ease financial anxiety. A Solopreneur Paycheck smooths out the rollercoaster ride of fluctuating revenue, by giving you a steady income amount each month. This can help take away the guilt of withdrawing money from your business even when you’re in the “off season”. Read more about creating one for yourself here.

If you liked this article, that might be a sign that some expert help with a year-end bookkeeping review could be just the ticket for you! Click below or right here to schedule a free Financial Self Care Consultation to see if a bookkeeping review can help you allay your anxieties and lay the groundwork for financial success.

A couple pointers for inspiration: if you feel like you’re not getting paid enough, check out my article on

A couple pointers for inspiration: if you feel like you’re not getting paid enough, check out my article on

The Function of Profit

The Function of Profit

create a financially streamlined business. Strategizing to prepare for surprise expenses and taxes, offer more of your most profitable products or services at the optimal time of year, and remembering to pay yourself all contribute to financial success. If you’re interested in doing this analysis work with some professional help, I’m happy to speak with you. Take a look at

create a financially streamlined business. Strategizing to prepare for surprise expenses and taxes, offer more of your most profitable products or services at the optimal time of year, and remembering to pay yourself all contribute to financial success. If you’re interested in doing this analysis work with some professional help, I’m happy to speak with you. Take a look at