How to Use Money Mapping To Give Back

At this moment, we are being called to give money to many different places. Community organizations need resources to respond to COVID-19, and so do many different non-profits, scholarship funds, etc. On top of that, the worldwide movement for Black lives has sparked a renewed need for donations. Last week, I discussed how a business owner can leverage their business to rise to this moment. Today, I want to talk about giving. Specifically, how to use money mapping to know how much to give!

Money Mapping: A Crash Course

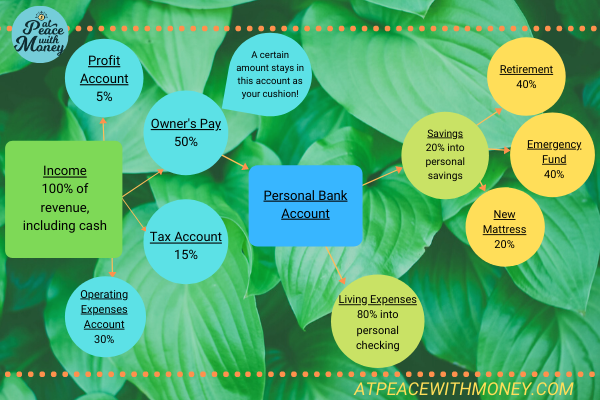

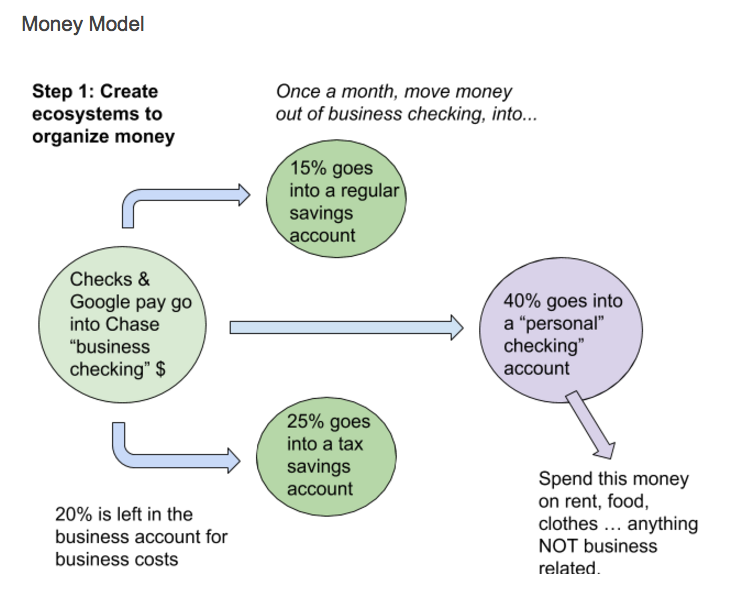

If you’re not familiar with the term money-mapping, it’s essentially a visual way to track and create a system for your money. When I work with my clients, we create these systems for their business together. By figuring out how much money you need to cover taxes and business expenses, you’re then able to see what’s left over. How you allocate that money is up to you. Typically it’s split between profit and pay for the business owner. In this article, I’m going to discuss how you can carve out a chunk of that money for donating to organizations you want to support. Earlier this year, I wrote a series on how to implement money-mapping for your business and personal finances; read that here. Here’s a diagram to give you a better picture of what I’m talking about.

Factoring in Giving

There are several different ways you can factor giving into your money map. If you’d like the donation to come directly from your business revenue, perhaps you decide that the 5% in the profit account will go to a certain organization. Depending on your flexibility, you could also simply choose to add another account altogether, and split up your revenue five ways instead of the four outlined in the diagram above.

If you’d prefer to give from your individual finances, your options are similar. Perhaps you can carve the donation from your savings allocations (perhaps replace “new mattress”). Or, you can choose to make room in your living expenses, provided you have that flexibility.

Sticking to a Timeline

When using the money mapping system, it’s good to use a timeline to know when it’s time to examine your accounts and move or use money that’s collected there. In my work with clients I usually suggest that they move or use the money in their profit account on a quarterly basis. If you’ve decided to use this money for donations, perhaps you can set up a system in your business to switch up where those donations go every quarter of the year.

Why Use This System?

Using money-mapping and seeing your donation as a percentage of your overall income strengthens the power of your giving. It helps you see exactly how much you can afford to give, and helps you make mindful choices about amount, rather than purely emotional ones. It can be helpful for people who are prone to over-spending and those prone to over-saving. Looking at your money as a full system also helps you assess your values and re-structure your priorities if needed. If you decide you’d rather donate to Black Lives Matter than eat out in the month of June, referring to your money map can help you make and track that choice.

Using money-mapping and seeing your donation as a percentage of your overall income strengthens the power of your giving. It helps you see exactly how much you can afford to give, and helps you make mindful choices about amount, rather than purely emotional ones. It can be helpful for people who are prone to over-spending and those prone to over-saving. Looking at your money as a full system also helps you assess your values and re-structure your priorities if needed. If you decide you’d rather donate to Black Lives Matter than eat out in the month of June, referring to your money map can help you make and track that choice.

If you’re looking for places to donate money to in order to support the movement for Black Lives, please consider checking out these organizations:

- Atlanta Solidarity Fund

- A list of bail funds for protestors across the country

- Movement for Black Lives

- Black Lives Matter

- Harriet Tubman Collective

- Pivot Diversity

- Stand Up Sundays

Happy giving!

Angela

Image By: Milada Vigerova

If you enjoyed this guide, I recommend also checking out

If you enjoyed this guide, I recommend also checking out

The Function of Profit

The Function of Profit

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to