The In-Depth Guide to Mapping Your Money, and How It Can Fortify Your Business, Part III

In the last two parts of this in-depth guide to money mapping, we’ve talked about why it’s helpful and how to get started. We’ve also touched on creating a system of accounts to set up a regular paycheck for yourself and an assurance of profit. Creating your own money map based on these ideas takes a lot of evaluation of your finances. You need to assess your operating and tax expenses and analyze your living expenses and savings goals. Once you’ve assessed these amounts, they translate into the percentages you put into each account.

What’s Your Percentage?

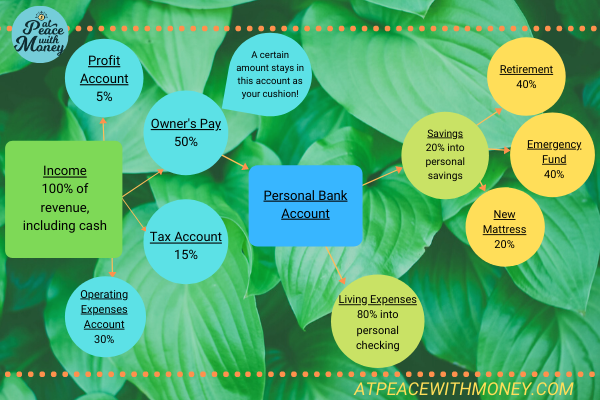

I help clients figure out what their percentages could be. We assess the needs of their business, and we figure out how much they actually need to live on. We discuss their life goals, and how those relate to money. There are good benchmarks for each percentage, which are suggested by Profit First. For your reference, the suggested percentages are: 5% profit, 50% owner’s pay, 15% taxes, 30% for operating expenses. This breakdown applies to most solopreneurs (anyone under $250,000 in annual revenue).If this doesn’t feel doable for you right now, don’t sweat it. It takes a lot of work, evaluation, and good financial habits to create a sustainable money system.

Applying the Model

Let’s look at an example of all of this mapped out. In this example business, the owner is using the ideal benchmarks and keeping a cushion in their Owner’s Pay account. What they do take out is then subdivided, with 20% of their pay taken off the top for three savings goals (I like to call this “paying yourself first.”). The remainder of this money goes to living expenses. While this model might be unrealistic from where you stand, keep in mind that this is something my clients work towards. I’ve included it here so you can start to picture what your own money system looks like.

If you enjoyed this guide, I recommend also checking out Part I, and Part II. And, try going to the Tools page, where you can play with an allocations calculator. Plug in your revenue and your preferred percentages to see what your amounts are! Then you can start filling in your money map.

If you enjoyed this guide, I recommend also checking out Part I, and Part II. And, try going to the Tools page, where you can play with an allocations calculator. Plug in your revenue and your preferred percentages to see what your amounts are! Then you can start filling in your money map.

Money mapping is an important tool, and one that I enjoy walking clients through. If you’re interested in working with me, check out my services page to check out my packages, and schedule a call.

Angela

Image by:

The Function of Profit

The Function of Profit