Roundup: At Peace With Money’s Best Educational Posts to Level Up Your Financial Learning

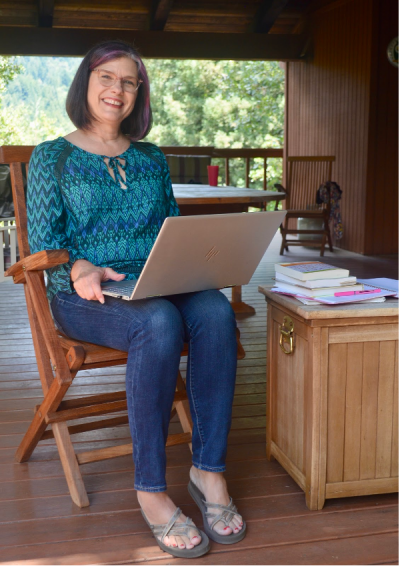

This week, please enjoy a roundup of some of my best educational posts yet. I’m getting close to my two-year blogging anniversary! In that time I’ve written up quite a few how-to’s, exercises, and perspective pieces on handling money. Below, I’ve pulled out some of my favorites, in the categories of business finance and personal finance. I’m recommending these articles in particular because they contain foundational info that informs my practice as a profitability coach. The tips and perspectives that I blog about here are tried and true. I share them because they make a huge difference to my clients, just as I hope they’ll make a difference for you! If you’re looking to kick your financial learning into high-gear, let these resources be your guides:

Personal Finance Articles

- Creating a Spending Plan

- A Guide to Saving

- Money and Marriage

- Financial Advice: How to Avoid the Bad and Find the Good

- Establishing Good Financial Habits

- Why You Need a Money Buddy

Business Finance Articles

- What’s Your Money Why?

- The In-Depth Guide to Money Mapping and How it Can Fortify Your Business, Part I, Part II, and Part III

- All About Oversaving, and Why Overcoming It Can Strengthen Your Business

- My series on financial self care for business owners: Working on Your Finances is Self Care, Why You Need to Separate Your Business and Personal Finances, Know What Your Numbers Are Telling You, and How to Set Informed Income Goals

- Getting Health Insurance If You’re a Solopreneur

- 5 Steps to Get Ready for Tax Time

- How to Build Your Best Money Team

- How to Focus Your Offerings to Create More Revenue

Suggested Readings – My Favorite Financial Books

- My series on Secrets of Six Figure Women by Barbara Stanny: What’s Your Money Mindset?, To Increase Your Earnings Take Action, Put Your Money to Work For You, and Claim Your Power

- Book Review: The Art of Money by Bari Tessler

- Book Review: Your Money or Your Life by Vicki Robin and Joe Dominguez

- Book Review: Proposals for the Feminine Economy by Jennifer Armbrust

I hope these posts are helpful for you! I find that the practice of writing a blog has been a great practice in building up an archive of knowledge – one that I hope is just as helpful for you as it is for my clients.

Angela

Making a regular habit of checking in with your finances. Make this easy by consolidating your passwords to your different accounts and portals. If you don’t have to go searching for passwords before you begin your checkin, you’re way more likely to actually do it!

Making a regular habit of checking in with your finances. Make this easy by consolidating your passwords to your different accounts and portals. If you don’t have to go searching for passwords before you begin your checkin, you’re way more likely to actually do it!

Your financial record-keeping is a data source in your business. By having clear records, you can start to trace the revenue trends in your business. You can use this data to analyze what offerings are the most profitable, and what expenses bring you the best returns. If you want to know more about this, read my article on

Your financial record-keeping is a data source in your business. By having clear records, you can start to trace the revenue trends in your business. You can use this data to analyze what offerings are the most profitable, and what expenses bring you the best returns. If you want to know more about this, read my article on

The past year and a half gave us more opportunities than ever to show up for our community as small business owners. I encourage you to think about organizations in your local community or on a larger level that you would like to show visible support for with your business. I wrote a post about thinking about your business’s role in your community called

The past year and a half gave us more opportunities than ever to show up for our community as small business owners. I encourage you to think about organizations in your local community or on a larger level that you would like to show visible support for with your business. I wrote a post about thinking about your business’s role in your community called

The Butterfly Effect dictates that small events have a rippling effect that can cause much larger events to occur. While you may feel that your contribution to the world is small, what you do ripples out. I love this quote from author and activist Grace Lee Boggs, who says, “We never know how our small activities will affect others through the invisible fabric of our connectedness. In this exquisitely connected world, it’s never a question of ‘critical mass.’ It is always about critical connections.”

The Butterfly Effect dictates that small events have a rippling effect that can cause much larger events to occur. While you may feel that your contribution to the world is small, what you do ripples out. I love this quote from author and activist Grace Lee Boggs, who says, “We never know how our small activities will affect others through the invisible fabric of our connectedness. In this exquisitely connected world, it’s never a question of ‘critical mass.’ It is always about critical connections.”