How to Use Your Profit First End-of-Year Profit Distributions

If you’re a business owner who follows the Profit First system, then along with all the other financial matters this time of year brings, you have another to address. What are you going to do with your Profit Distribution?

What’s a Profit Distribution?

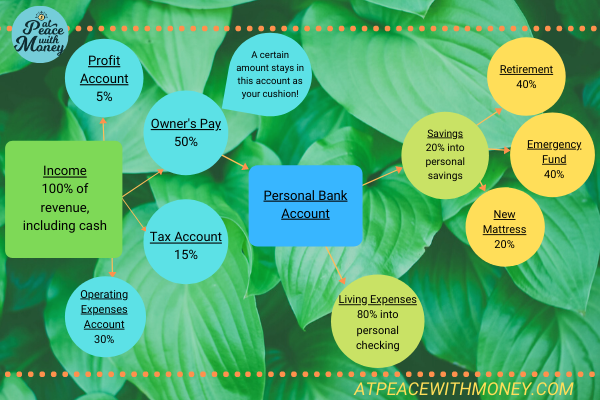

In the second article in my series on money-mapping, I describe Profit Distributions this way:

The profit account accumulates and then is distributed quarterly. Business owners are encouraged to use their Profit Distributions to reward themselves for their hard work. This keeps the owner excited about and invested in the business. It also discourages any tendency to reinvest everything back into the business, or over-save. Rewards can range from a day out to charitable giving, to really anything you want!

Profit Distributions are intended as rewards for the business owner. Think of them as a way to reward yourself for your hard work, by using this bit of extra money in a way that aligns with your values and brings you more of what you want into your life.

Some End-of-Year Ideas

If you stick to the quarterly system, you have two profit distributions bookending the holiday season. One falls at the end of September and the other at the end of December. There are many different ways to put this money to use. Even if your business is small, or just getting started, you can still do a lot with your profit distribution. A couple ideas include:

- Holiday purchases – put the money towards an extra-special gift for someone you love

- Generosity – use the money to donate to a cause you’re passionate about, or consider rewarding your employees with holiday bonuses

- Travel – many folks like to go out of town this time of year. Perhaps you can put your profit distribution towards this!

The key to profit distributions is to use them. Ideally, you check in with your values and make a choice to spend the money on the thing that will most rejuvenate and enrich you. This can be especially important to remember during the holiday season, when things may feel fast-paced and stressful in your business or personal life.

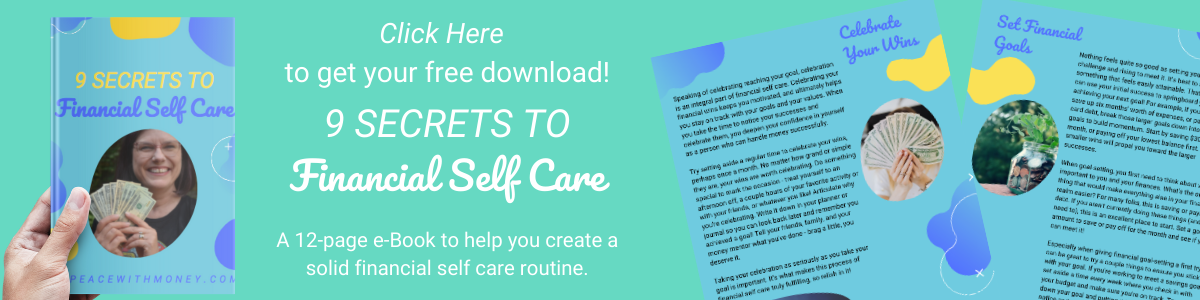

I hope these ideas inspire you to treat yourself well come end-of-year! If you’re interested in more ideas like this, you might like to read my eBook, 9 Secrets to Financial Self-Care! Download it free here.

The past year and a half gave us more opportunities than ever to show up for our community as small business owners. I encourage you to think about organizations in your local community or on a larger level that you would like to show visible support for with your business. I wrote a post about thinking about your business’s role in your community called

The past year and a half gave us more opportunities than ever to show up for our community as small business owners. I encourage you to think about organizations in your local community or on a larger level that you would like to show visible support for with your business. I wrote a post about thinking about your business’s role in your community called

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to

This year has given us more opportunities than ever to show up for our community as small business owners. I encourage you to think about organizations in your local community or on a larger level that you would like to show visible support for with your business. I wrote a post about thinking about your business’s role in your community called

This year has given us more opportunities than ever to show up for our community as small business owners. I encourage you to think about organizations in your local community or on a larger level that you would like to show visible support for with your business. I wrote a post about thinking about your business’s role in your community called

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to

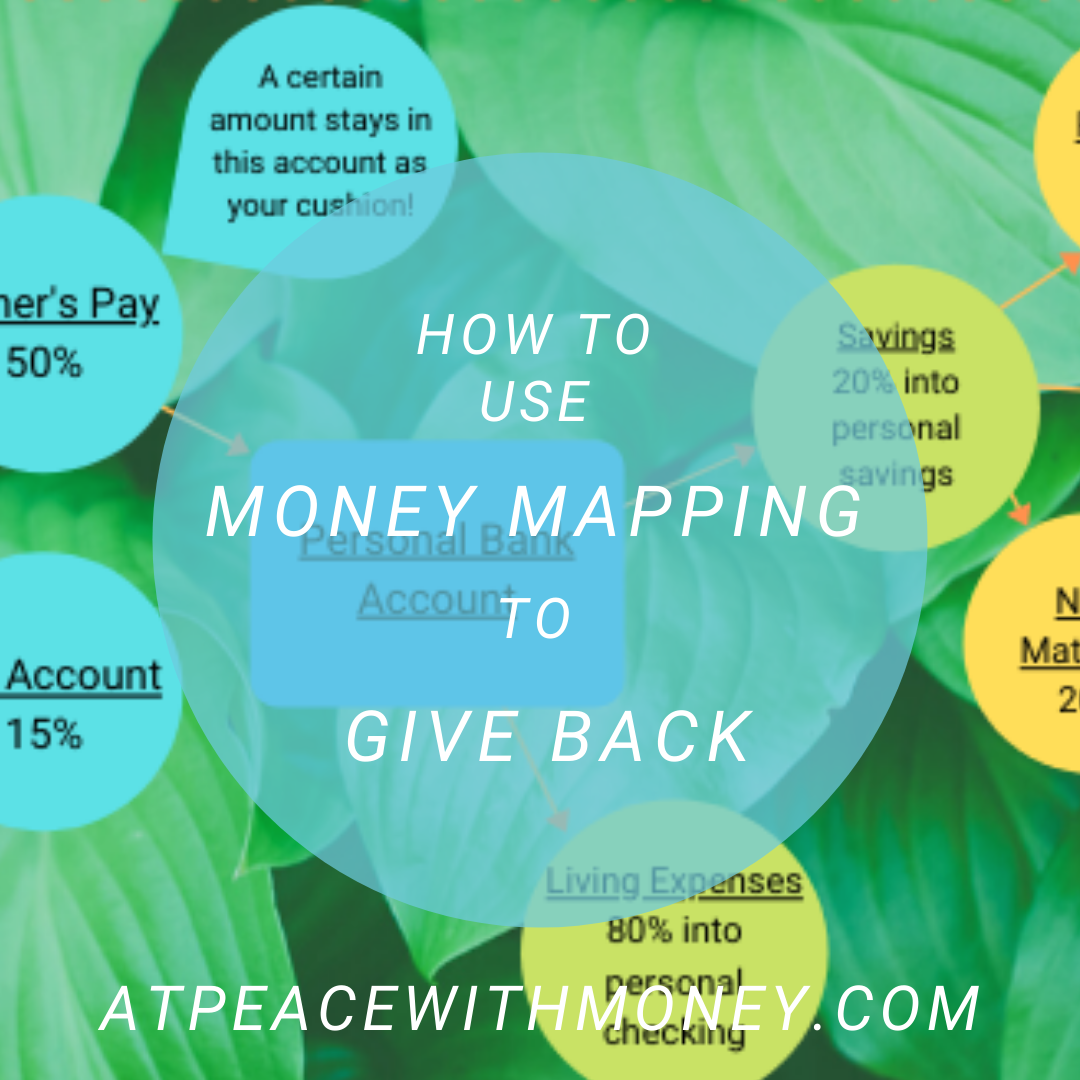

Using money-mapping and seeing your donation as a percentage of your overall income strengthens the power of your giving. It helps you see exactly how much you can afford to give, and helps you make mindful choices about amount, rather than purely emotional ones. It can be helpful for people who are prone to over-spending and those prone to

Using money-mapping and seeing your donation as a percentage of your overall income strengthens the power of your giving. It helps you see exactly how much you can afford to give, and helps you make mindful choices about amount, rather than purely emotional ones. It can be helpful for people who are prone to over-spending and those prone to