How to Create Your Own Paycheck Using a Money System

I know you like being your own boss, but do you ever have paycheck envy? Do you ever wish you could get a paid vacation? Do you get tired of the feast or famine in your personal income? Especially with creative or freelance work, this can be a real issue for some of us. Fortunately, when you create money systems around your business income, you can create a solopreneur paycheck, by paying yourself first.

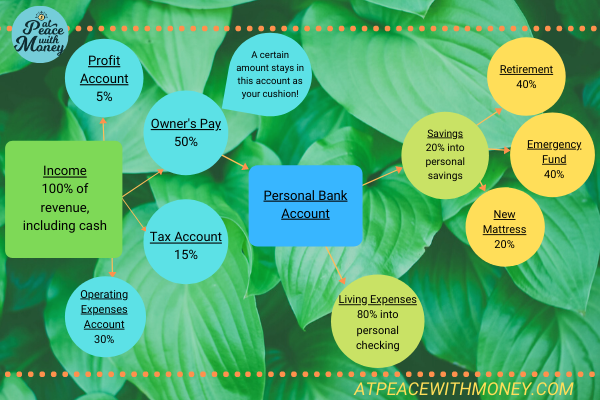

The System

Setting up a paycheck for yourself is simple. Every time you collect income, set aside a portion in a separate account just for your pay. Then pay yourself out of that account, but leave a portion in the account. The balance in this account will build over time so that you eventually have a cushion built up to even out dips in income, or even pay yourself while you take a holiday.

Determining Amounts

How much should you pay yourself each round? A good place to start is keeping track of your personal expenses and ensuring you cover those every month. After that, it’s a simple question of what to do with any extra income you may have made that month. You may choose to leave it all in the account to build up your balance, or take out an extra allowance if you’ve earned a reward. Setting up reward systems for yourself can be another motivator to keep your money systems consistent, organized, and ensure they meet your needs.

More in-depth information on creating a solopreneur paycheck can be found in my money mapping series. Part II discusses setting up a solopreneur paycheck in the context of your larger money system.

If you liked reading this, you might enjoy my free eBook, the Cash Flow Reboot Guide. This resource gives you a bunch of actionable steps to take to ensure that your business can thrive through times of financial uncertainty. Click below to grab your free copy!

Your financial record-keeping is a data source in your business. By having clear records, you can start to trace the revenue trends in your business. You can use this data to analyze what offerings are the most profitable, and what expenses bring you the best returns. If you want to know more about this, read my article on

Your financial record-keeping is a data source in your business. By having clear records, you can start to trace the revenue trends in your business. You can use this data to analyze what offerings are the most profitable, and what expenses bring you the best returns. If you want to know more about this, read my article on

Using money-mapping and seeing your donation as a percentage of your overall income strengthens the power of your giving. It helps you see exactly how much you can afford to give, and helps you make mindful choices about amount, rather than purely emotional ones. It can be helpful for people who are prone to over-spending and those prone to

Using money-mapping and seeing your donation as a percentage of your overall income strengthens the power of your giving. It helps you see exactly how much you can afford to give, and helps you make mindful choices about amount, rather than purely emotional ones. It can be helpful for people who are prone to over-spending and those prone to

#4 – You should have received all of your tax mailings by mid-February. If your tax preparer is going to want everything in electronic form (or you just want to stay super organized) scan all of your paper statements and add them to your 2017 Tax Documents folder.

#4 – You should have received all of your tax mailings by mid-February. If your tax preparer is going to want everything in electronic form (or you just want to stay super organized) scan all of your paper statements and add them to your 2017 Tax Documents folder.

afternoon off, a fun or inspiring event, or whatever you’d like to do to celebrate your achievements so far! Being a self-starting solopreneur is hard work. If you’ve done the work, you deserve to cheer yourself on once in a while.

afternoon off, a fun or inspiring event, or whatever you’d like to do to celebrate your achievements so far! Being a self-starting solopreneur is hard work. If you’ve done the work, you deserve to cheer yourself on once in a while.

When you’re making your plan, be sure to adapt your goals to what’s worked so far this year. If you really love a certain routine or feel fired up to keep working toward a certain goal, go for it. If you’ve stalled on a project because you need to do more research, carve out some time to go back to the drawing board. When charting your course, keep your own needs and preferences in mind.

When you’re making your plan, be sure to adapt your goals to what’s worked so far this year. If you really love a certain routine or feel fired up to keep working toward a certain goal, go for it. If you’ve stalled on a project because you need to do more research, carve out some time to go back to the drawing board. When charting your course, keep your own needs and preferences in mind.

account to build up your balance, or take out an extra allowance if you’ve earned a reward. Setting up rewards systems for yourself can be another motivator to keep you money systems consistent, organized, and ensure they meet your needs.

account to build up your balance, or take out an extra allowance if you’ve earned a reward. Setting up rewards systems for yourself can be another motivator to keep you money systems consistent, organized, and ensure they meet your needs.