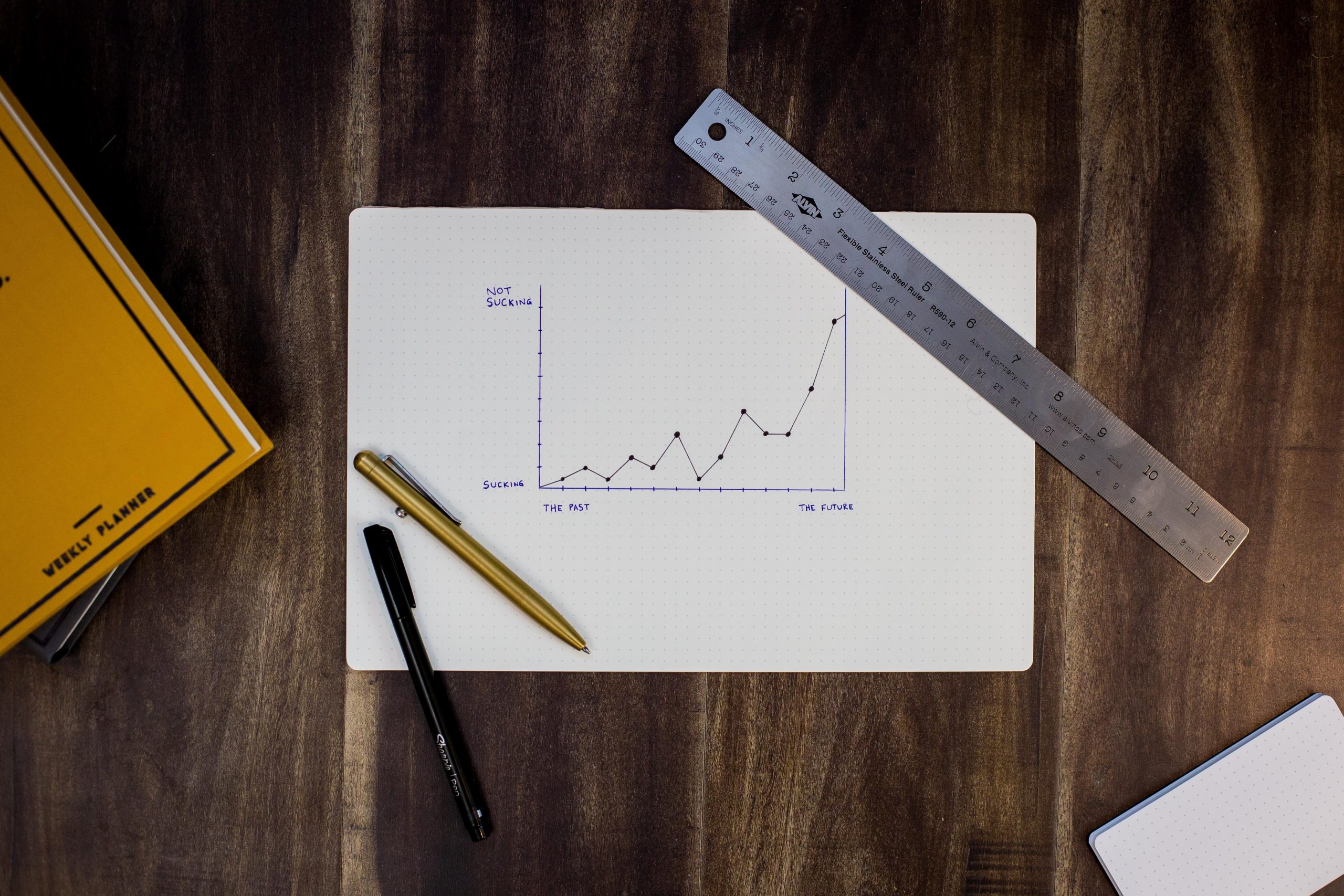

Reduce the Hassle: 3 Tips to Keep Your Money System Simple

When I work with small business owners I often run see this one unfortunate pattern; many business owners believe that your money system has to be complex in order to work. The reality, however, couldn’t be further from that. We’ve already talked about how important having a money system is, and how to visualize it with money-mapping. Keeping your money system simple and streamlined makes it easier to visualize, but also much easier to follow through on and keep organized. If a system requires a bunch of checking in or spreads your money into a bunch of accounts you forget about, it’s not worth the maintenance. Here are three strategies you can use to pare down your business’s money system to a manageable size.

Limit Your Cards

If you’ve got a ton of cards under your business, keeping track of all of them and keeping them paid off can be difficult. To make it easier on you, I suggest paring down the number of cards you use. This will help you better keep track of your bills, credit rewards, and any other info associated with your cards.

Please note, I’m not advocating for closing any of your credit cards, as this can lead to a lowering of your credit score. However, here’s a good guide on how to do that, if you’re interested.

Under One Roof

One recommendation I regularly make to my clients is to consolidate their money into one institutions. If you have business bank accounts at three, four, or five different banks, that’s gotta be hard to stay on top of! Getting it all under one roof will help you keep an eye on your finances as a whole more easily. If you have multiple banks and you’re wondering how to go about consolidating, you might like to read this piece about switching banks we featured a couple years ago. It contains a guide to comparing banking offers and picking to the best option.

Keep Track

Making a regular habit of checking in with your finances. Make this easy by consolidating your passwords to your different accounts and portals. If you don’t have to go searching for passwords before you begin your checkin, you’re way more likely to actually do it!

Making a regular habit of checking in with your finances. Make this easy by consolidating your passwords to your different accounts and portals. If you don’t have to go searching for passwords before you begin your checkin, you’re way more likely to actually do it!

I also recommend using an app or other tracking system. I especially like Mint.Others also like YNAB, or paper money tracking. Digitally tracking your money can save you some time, while also giving you a quick snapshot of your accounts when you need it.

If you found these tips helpful, you might also like this article on automation, which is another money hack to keep your systems tidy!

Angela