How to Develop Good Money Tools So You Can Be As Generous As You Want

I know many kind and generous people who wish to give money to organizations or causes they support, or simply other people in the community who are in need. However, sometimes being clear on how much you can afford to donate is difficult.

To clear this up, you need to develop a solid financial base for yourself. I’m talking about using a spending plan, a savings plan, and money mapping to get clear on where your money is going. Let’s look at how each of these three tools can help you give more easily:

Spending Plan

First, you need to know how much you’re spending and where it’s going. Take a walk through your income and expenses and figure out how much you’re saving, if you are saving. The point of developing a spending plan (also known by the less-fun-sounding-term “budget”) is to get clear on what your spending is like right now, and how it compares to your income. When you look at this, you can see what your spending priorities currently are, and you can start to think about that critically. Do you really want to eat takeout food every week, or would you rather be able to donate that $35 to a conservation campaign like Protect Juristac? Looking at your spending and weighing your priorities can make room for the giving you want to do. To develop a good spending plan, check out my article with ideas and strategies here.

Savings Plan

Saving money gives you serious options, whether you’re saving for an emergency fund or a big purchase. You can also decide to dedicate a portion of your savings directly to giving. Maybe, you decide to save 5% of your income every month and donate it to the COVID-19 Hopi Relief Fund at the end of the year. Whether the giving comes out of your savings or your spending plan, having both gives you a fuller picture of how you can spend, give, and save for your goals. You can read more about creating a savings plan for yourself here.

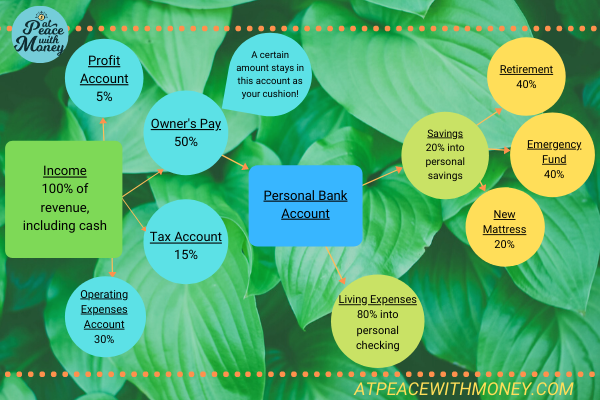

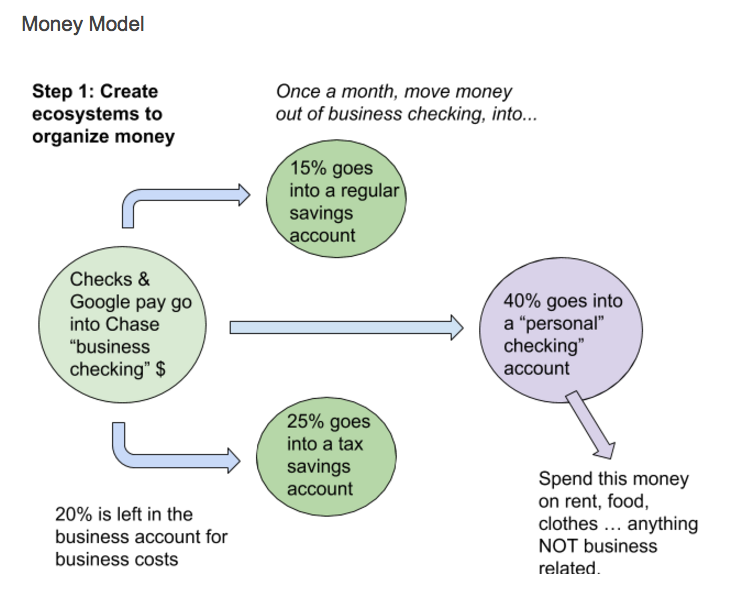

Money Mapping

Once you’ve got the spending and the saving figured out, you can put it all together into a money map! Money mapping is a visual tool for organizing your own money system. It’s super helpful for both your business and personal finances. I’ve talked about the how-to of money mapping quite a bit on this blog, so I won’t go into detail. I recommend reading my full series on money mapping, and especially How to Use Money Mapping to Give Back. The big pro of money mapping is that you can visually parse out how you will allocate for giving money. Whether it’s coming out of your business finances, your monthly living expenses, or you’re saving a big sum, creating a money map helps you see that and stick to it.

Want to Give? Get Organized!

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to schedule a free consultation!

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to schedule a free consultation!

Happy giving!

Angela

This blog post is a re-publishing of the original article, “How to Make Donating Way Easier on Your Finances,” published in November 2020. For more articles on this topic, check out the “giving” tag.

Whether you decide to create a spending plan and reign in your expenses, or feel satisfied with your lifestyle costs, you now have a complete picture of your financial needs. At this point, you can now set informed income goals that are designed to meet those needs in your personal life. Without this crucial information, your goals will just be shots in the dark, aimed at an amount of money that “sounds nice” but doesn’t tangibly satisfy a need.

Whether you decide to create a spending plan and reign in your expenses, or feel satisfied with your lifestyle costs, you now have a complete picture of your financial needs. At this point, you can now set informed income goals that are designed to meet those needs in your personal life. Without this crucial information, your goals will just be shots in the dark, aimed at an amount of money that “sounds nice” but doesn’t tangibly satisfy a need.

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to

The bottom line here is that donating money from a solid financial base requires getting organized. You need to go over your financial priorities and see what kind of money you have to work with. From there, you can make an informed and generous decision about where to put your money, without putting yourself in dire financial straits. I hope you found this article helpful. Currently, I have a few openings in my practice for some personal finance coaching clients, so if you’d like to work closely on your personal finances and develop a giving plan with support, reach out to

You may have some idea of whether you fit into either category. If you’re not sure what over-saving is, I recommend

You may have some idea of whether you fit into either category. If you’re not sure what over-saving is, I recommend

The bottom line here is that it’s important to look at both your personal and your business finances separately, and as they relate to each other. We have to look at the whole pie, so to speak. Many business owners might have one field or the other down pat, but having confidence in both areas takes a bigger understanding of how they work together. If you feel you have a lot of clarity in your business but struggle to pay personal bills, or vice versa, it’s time to take a step back and re-evaluate. The two inform each other.

The bottom line here is that it’s important to look at both your personal and your business finances separately, and as they relate to each other. We have to look at the whole pie, so to speak. Many business owners might have one field or the other down pat, but having confidence in both areas takes a bigger understanding of how they work together. If you feel you have a lot of clarity in your business but struggle to pay personal bills, or vice versa, it’s time to take a step back and re-evaluate. The two inform each other.

If you enjoyed this guide, I recommend also checking out

If you enjoyed this guide, I recommend also checking out

The Function of Profit

The Function of Profit

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.