How to Prepare Your Business for a Fulfilling Last Quarter

Preparing your business for the final quarter of the year is crucial to both business profits, and your own personal fulfillment. It’s easy to get caught in the holiday rush. Instead, set aside some time to be more intentional. Think about how you want the next three months to go.

Today, let’s talk about a couple different exercises you can use to reflect on your year so far and plan for the time ahead. If you’re feeling ready for a fully fleshed-out review process, you can also check out my article on doing a business check-in.

Reflect and Celebrate the Past 9 Months

Take some time to acknowledge how far you’ve come in the last nine months. If you set yearly goals, check in with the progress you’ve made. Then take a look at all the other things that came your way this year. Even the most focused of us get sidetracked by one thing or another. Running a small business involves a lot of surprises and opportunities. What did you do this year that was unexpected? What are you glad you had the chance to do or participate in?

Take stock of all the progress and change from this year. If it doesn’t feel like much, compare where you are now to this time last year. Celebrate and congratulate yourself. If you have a profit account, distribute your profits and reward yourself.

Review and Tweak Your Goals

Now, take another look at any goals you’ve set. Ask yourself a couple questions about them:

- Do you need to tweak them or change them to make them more realistic?

- Do they still resonate with you?

- How can you reach out for support with meeting these goals?

Factor in the holidays and make sure you’re giving yourself the time and space you need for other parts of your life as well. Any income goals you’re working toward should be based on your actual lifestyle needs, not just numbers that sound nice.

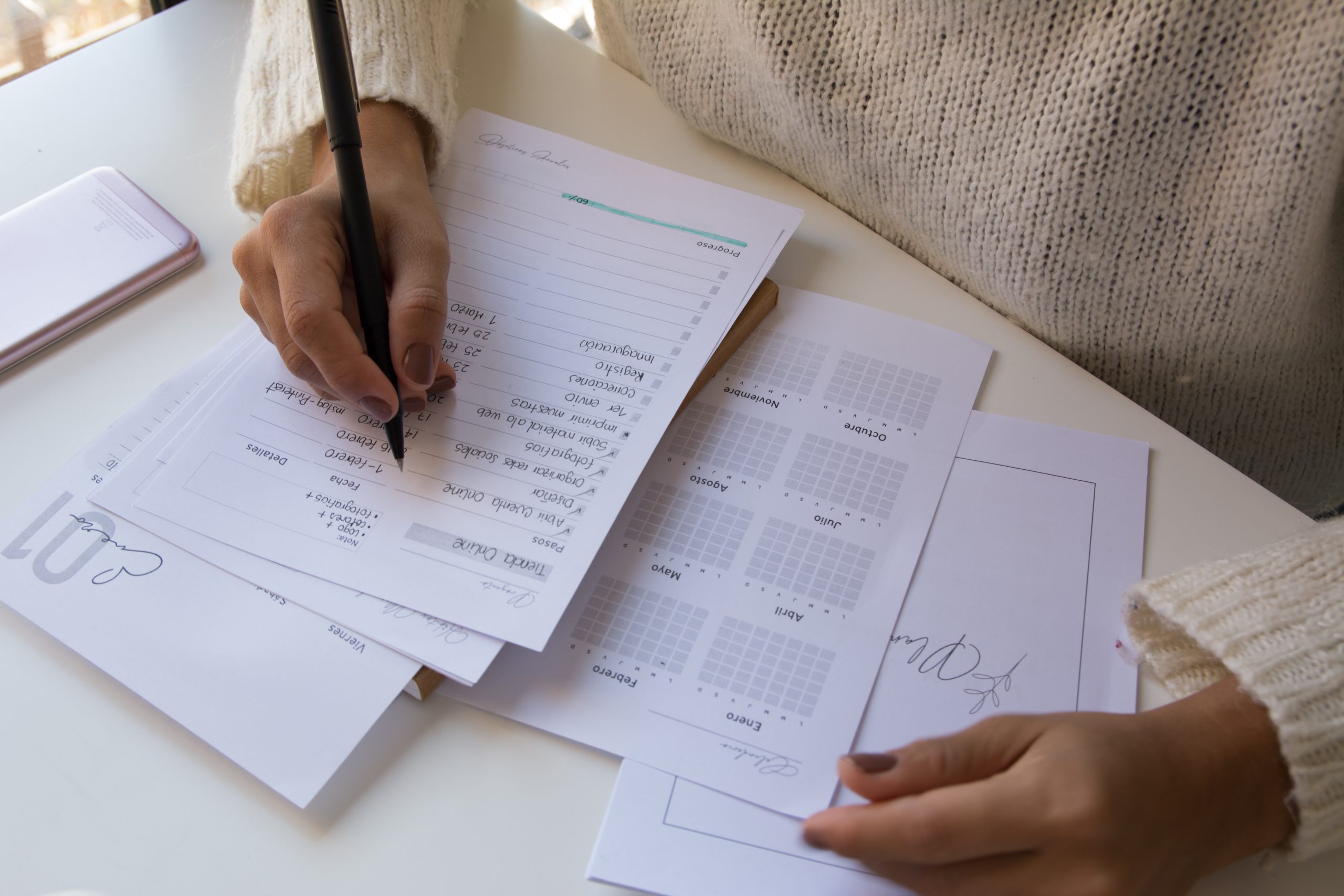

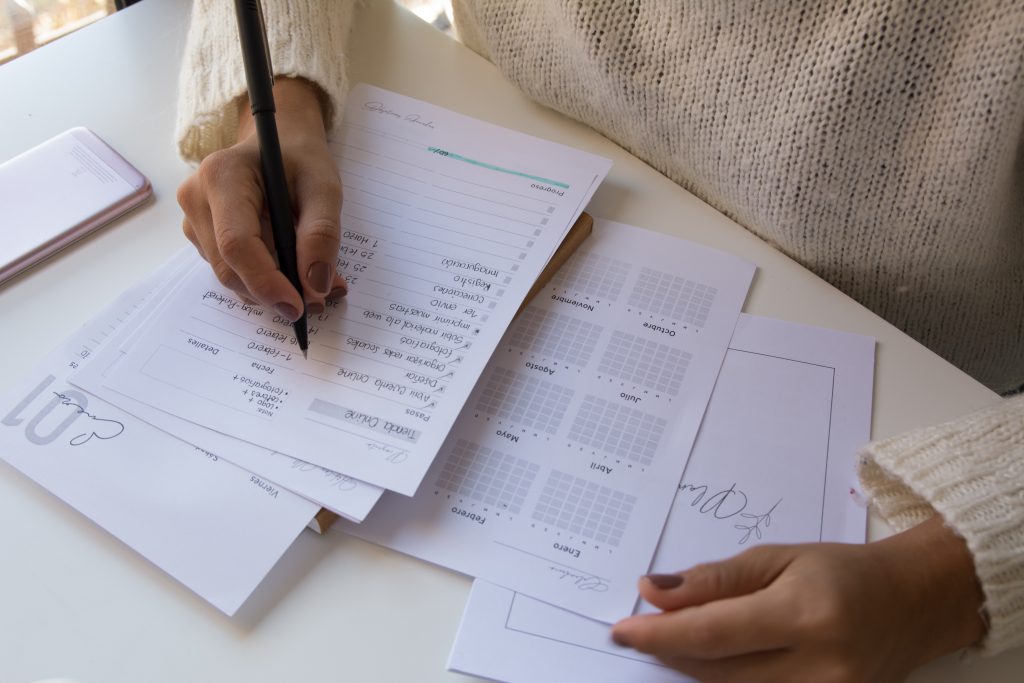

Backwards Timeline

Once you’ve got your goals in place, it’s time to make a plan to reach them over the next three months. One technique I love for charting a path toward goals is called backwards timelining. Essentially, this means is planning backwards from the point in time when you want to have achieved the goal. Make a plan for each goal, divide the plans up into baby steps, and map them out over time.

In this case, you would plan backwards from December. I highly recommend that you also plan to take some time off for the winter holidays, so factor that into your plan! If you don’t want to be working up until the 31st, start your timeline at Friday December 17th, or a similarly spacious date.

In this case, you would plan backwards from December. I highly recommend that you also plan to take some time off for the winter holidays, so factor that into your plan! If you don’t want to be working up until the 31st, start your timeline at Friday December 17th, or a similarly spacious date.

Along with considerations for what will likely be a busy holiday season in your already full life, it’s important to keep your time optimism in check. “Time optimism” refers to a person’s tendency to overestimate how quickly they’ll be able to get a specific task done. Especially if your plan to reach a goal requires doing tasks you’re less familiar with, it’s important to ward against time optimism. You’re likely unsure how long those unfamiliar tasks may take to complete. A simple technique to give yourself ample time to complete a task is to simply double the amount of time you think you’ll need.

If you enjoyed this resource on preparing your business for the last quarter of the year, you’ll probably also like reading The Cash Flow Reboot Guide, my free eBook on adapting your business to changing financial circumstances. It’s 9 pages and full of quick tips and ideas to help you plan out a stellar last quarter of 2021. Download it for free here.

Angela

Photo by Priscilla Du Preez

Your financial record-keeping is a data source in your business. By having clear records, you can start to trace the revenue trends in your business. You can use this data to analyze what offerings are the most profitable, and what expenses bring you the best returns. If you want to know more about this, read my article on

Your financial record-keeping is a data source in your business. By having clear records, you can start to trace the revenue trends in your business. You can use this data to analyze what offerings are the most profitable, and what expenses bring you the best returns. If you want to know more about this, read my article on

Now that I’ve made a case for separating your business and personal finances, let’s go over two different ways you can do this. In the beginning of this article, I mentioned that some solopreneurs think its sensible to avoid opening another account. It’s true that this can help you bypass banking fees associated with business accounts.

Now that I’ve made a case for separating your business and personal finances, let’s go over two different ways you can do this. In the beginning of this article, I mentioned that some solopreneurs think its sensible to avoid opening another account. It’s true that this can help you bypass banking fees associated with business accounts.

Above all else, when faced with a decision around your business, refer back to your

Above all else, when faced with a decision around your business, refer back to your

This is a good idea whenever you’re making any financial decision. Take a look at your income and expenses and see how things are going with your savings. Making a regular habit of doing this is immensely helpful and can simplify financial decisions like this one. My e-Book

This is a good idea whenever you’re making any financial decision. Take a look at your income and expenses and see how things are going with your savings. Making a regular habit of doing this is immensely helpful and can simplify financial decisions like this one. My e-Book

The past year and a half gave us more opportunities than ever to show up for our community as small business owners. I encourage you to think about organizations in your local community or on a larger level that you would like to show visible support for with your business. I wrote a post about thinking about your business’s role in your community called

The past year and a half gave us more opportunities than ever to show up for our community as small business owners. I encourage you to think about organizations in your local community or on a larger level that you would like to show visible support for with your business. I wrote a post about thinking about your business’s role in your community called

The Butterfly Effect dictates that small events have a rippling effect that can cause much larger events to occur. While you may feel that your contribution to the world is small, what you do ripples out. I love this quote from author and activist Grace Lee Boggs, who says, “We never know how our small activities will affect others through the invisible fabric of our connectedness. In this exquisitely connected world, it’s never a question of ‘critical mass.’ It is always about critical connections.”

The Butterfly Effect dictates that small events have a rippling effect that can cause much larger events to occur. While you may feel that your contribution to the world is small, what you do ripples out. I love this quote from author and activist Grace Lee Boggs, who says, “We never know how our small activities will affect others through the invisible fabric of our connectedness. In this exquisitely connected world, it’s never a question of ‘critical mass.’ It is always about critical connections.”

If you’ve already priced your products and wound up in a similar situation to the woman above, you can still double back and figure out your true income targets and prices. The real challenge comes in actually implementing a rate change. Before you do this, it can be helpful to

If you’ve already priced your products and wound up in a similar situation to the woman above, you can still double back and figure out your true income targets and prices. The real challenge comes in actually implementing a rate change. Before you do this, it can be helpful to