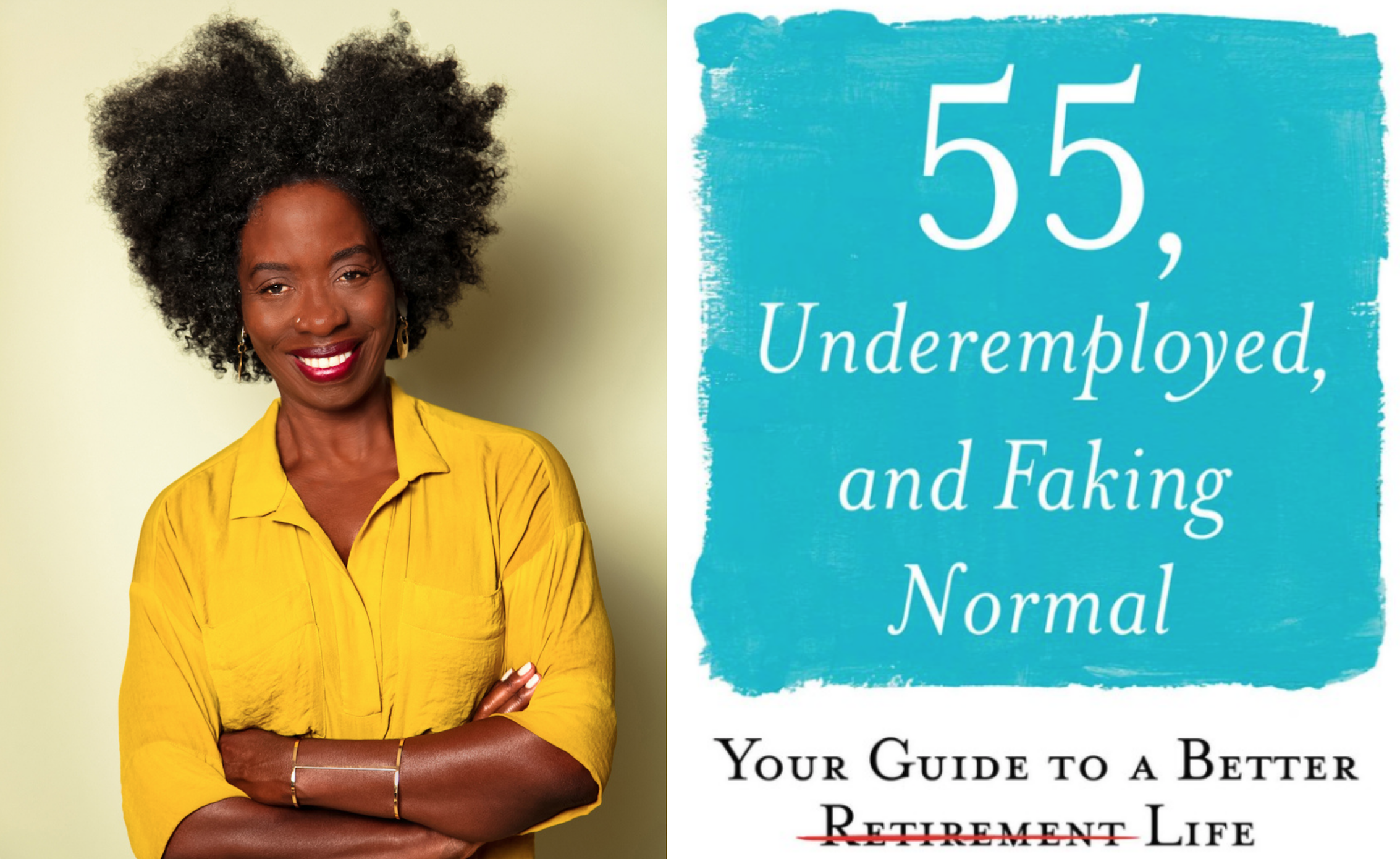

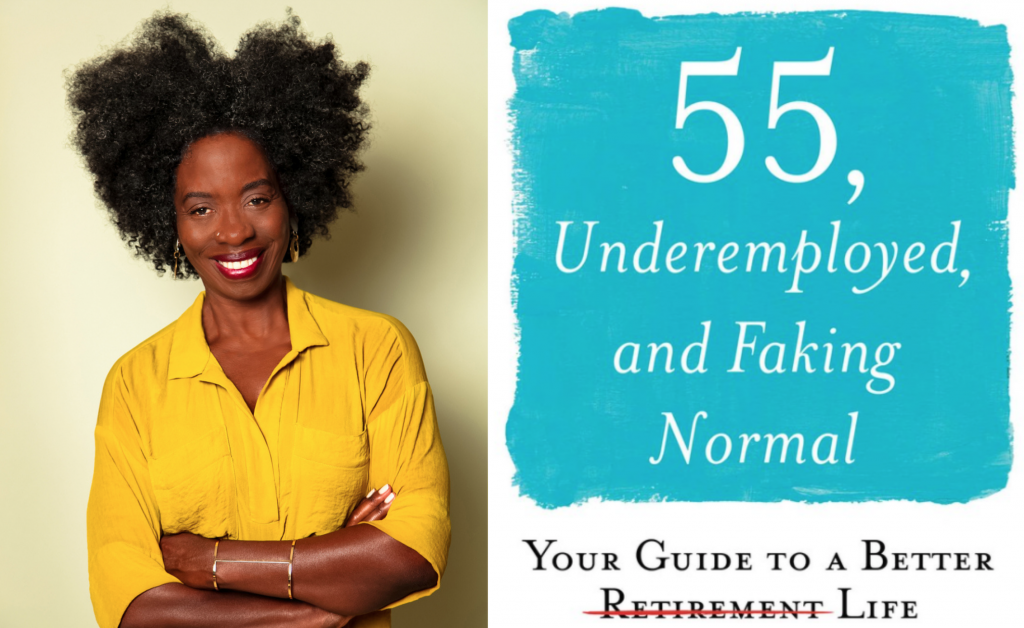

Book Review: 55, Underemployed, and Faking Normal by Elizabeth White

Elizabeth White might know impostor syndrome better than many of us. In her book, 55, Underemployed, and Faking Normal, she discusses the financial insecurity that has become a reality for many older people, women, and marginalized groups in the workforce. This book is emotionally uplifting and full of resources. Here are a couple of my favorite points from the book:

Unshaming Underemployment

What’s so interesting about this book is the way it’s starting a conversation that seems to be sorely needed. Case in point: Elizabeth White originally began this book project after first penning an essay on the same topic online. It got a huge response, because so many people are in a situation where they are experiencing the same level of financial insecurity and ageism.

Not only does this book bring this topic out into the light, but the author also does a wonderful job of absolving older and vulnerable people of the shame they may be feeling around their finances. She discusses many different contributing factors, including our changing retirement system, healthcare system, ageism in the workplace, women and minorities earning less, and women living longer. She points out skillfully that these are not things individuals can control.

Seeking Support

Along with this robust discussion of societal factors, the author also brings in a guide to creating support groups. She terms these “Resilience Groups.” She describes these groups as small groups of people coming together to discuss their financial circumstances openly with one another. They can be a hub for information- and resource-sharing, and group problem-solving.

If you’ve read my blog for awhile, you’ll know that having open and honest conversations about money with other people in your life is something I advocate for consistently. Creating space in multiple relationships in your life to talk about money is very important. It’s one of the best ways to release the shame of whatever financial situation you may be dealing with. As Elizabeth White points out, it’s also a great way to access resources and new perspectives on your situation. For more reading on these ideas, check out my articles on money buddies, building a money team, and finding a mentor.

Busting Through Denial

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”

This point resonate deeply for me, as something I often work on with my clients is helping them uncover their values and shape their finances to better reflect what’s important to them.

You can learn more about this book on Elizabeth’s website. The book is both an important wakeup call and a helpful resource. I highly recommend reading it! I hope you enjoyed this review. If you’d like to get connected with more of my content, sign up for my newsletter! Blog posts are delivered to your inbox every week, along with a monthly tailored note to you from yours truly.

Angela

Image: Elizabeth White