Retirement Planning for Solopreneurs: How to Find a Trusted Financial Adviser

It’s very helpful to have a trusted adviser take a look at your financial situation. Particularly when you don’t have the support or typical options offered by a corporate job, it can be helpful to get outside recommendations. But how do you find the resources you need from someone who is trustworthy?

What is Good Financial Advice? My Thoughts

One of my big goals with At Peace With Money is to help solopreneurs who don’t manage enormous accounts feel like they too can take steps down a helpful financial path. I strongly believe that no matter what amount of money you make, there are steps you can take to improve your situation and take care of yourself in the long term. I also believe you can do this without hugely sacrificing your quality of life. It doesn’t feel good to be chastised for your income level or your lifestyle, especially when class structure in the U.S. effects us in a way that means we are often not fully responsible for our financial standing. I don’t think that’s the role of financial advice anyway! Instead, good advice meets you where you’re at, and helps you get where you want to go.

Know What You Need

Once you’ve decided to find financial advice resources that are relevant to your lifestyle, it’s important to know where you’re at personally. So, be sure to check in with your own finances. If you need a simple process to get clear, check out my Three Steps to Financial Clarity exercise.

Once you’ve done that, you should have a clear idea of your current income level and your hopes for your financial future. Both of these things will help you determine what financial resources are best for you. At the beginning of your journey, you might not be interested in people who talk about managing large investments. That can always come later! Instead, you might be interested in resources that cater specifically to people who’ve just opened an IRA.

My Recommendations

- Especially for younger people or people who don’t have big portfolios, I recommend working with XY Planning Network. They will work on a project-basis, which makes their advising services more accessible.

- Many people also like working with Vanguard. They have a lower fee and have people on staff to help advise you.

If you enjoyed this article, you’ll probably appreciate a copy of my free e-Book, Reach Your Life Goals: A Business Owner’s Guide. Click here or below to get your free download!

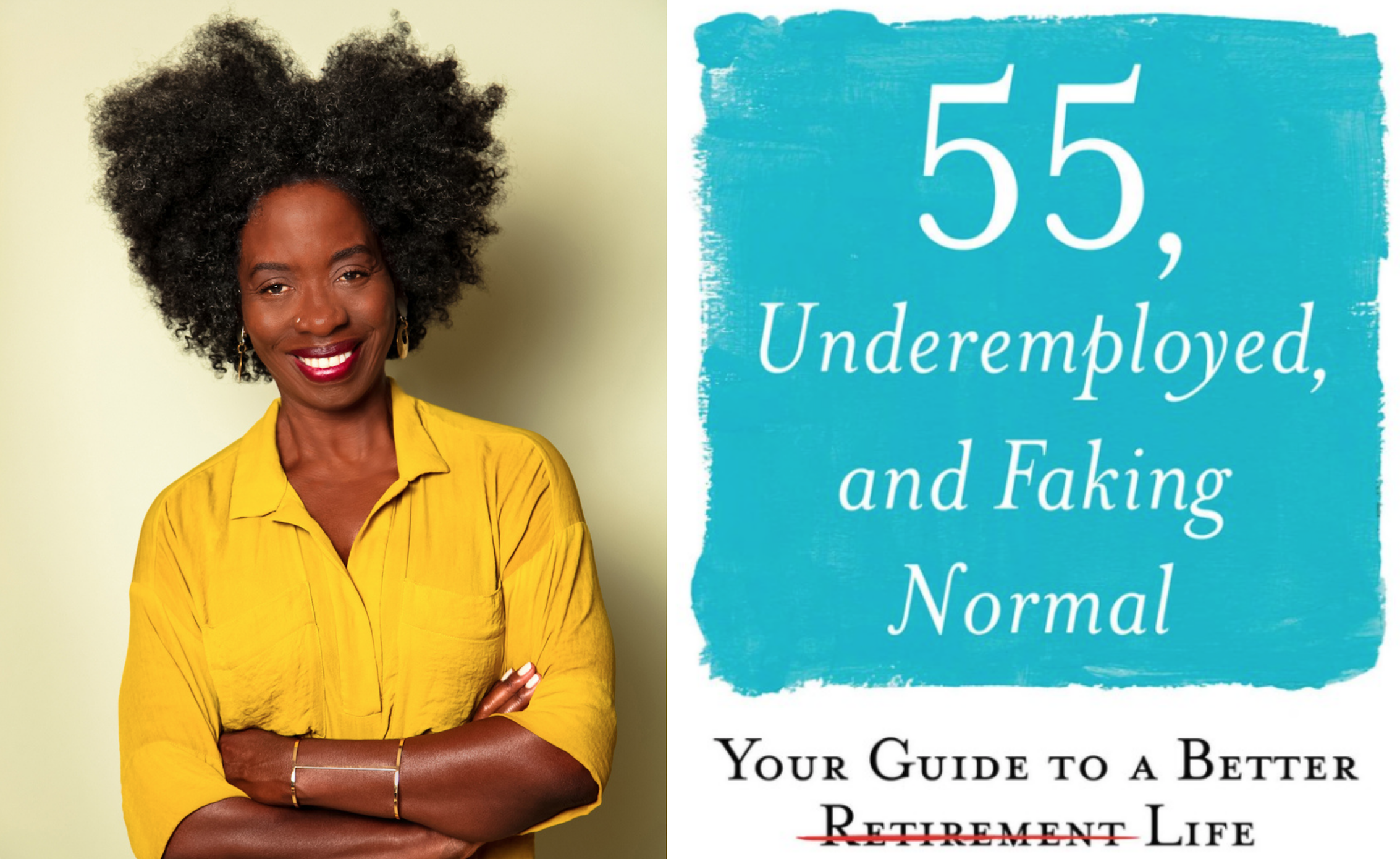

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”