How to Manage Your Money Like a Pro with Automation

Have you heard of decision fatigue? The idea is pretty simple. According to this article from the AMA, decision fatigue refers to “the idea that after making many decisions, your ability to make more and more decisions over the course of a day becomes worse.” Thanks to this phenomenon, it pays to reduce the number of decisions you need to make in a day. That’s where automation comes in.

Automation = Better Financial Habits

Automation is your money’s best friend. By automating your finances, you reduce your opportunities for decision making and decision fatigue, thereby reducing your chances to change your mind about saving money or paying a bill in full. By reducing your decisions you set yourself up for success! Automation can build up your savings and pay off your bills, without any extra effort on your part. So, how can you use automation as a financial tool?

Automate Your Bill Payments

There are many different facets of your finances which can benefit from automation. Automating your bills is a good place to start. Many banks have online bill pay options available that help you pay your regular monthly bills on time. In particular, automation is a good way to ensure you always pay your credit card balance in full, so that you don’t accrue any interest fees. However, one important thing to be aware of when automating your bills is that you will need to stay aware of your bank balance, to avoid over-drafting your account. As long as you keep an eye on your balance, automating your bills is a good way to avoid late fees, build good credit, and stay on top of your finances.

Automate Your Savings

The other major arena of your finances that definitely deserves some automation-attention is your savings. I touched briefly on automating your savings in an earlier article, which you can read here. The most important thing about automating your savings is that if money automatically gets moved out of your spending account, you have no chance to spend it. That makes saving that much easier! We do this with our retirement savings, and it really helps us keep it up. A great resource for further information about automating your savings is The Automatic Millionaire by David Bach.

If you liked this article and want more tips on financial organization that will make your life a LOT easier, you’ll probably enjoy a free copy of my eBook, 9 Secrets of Financial Self Care. Click here or below to download it!

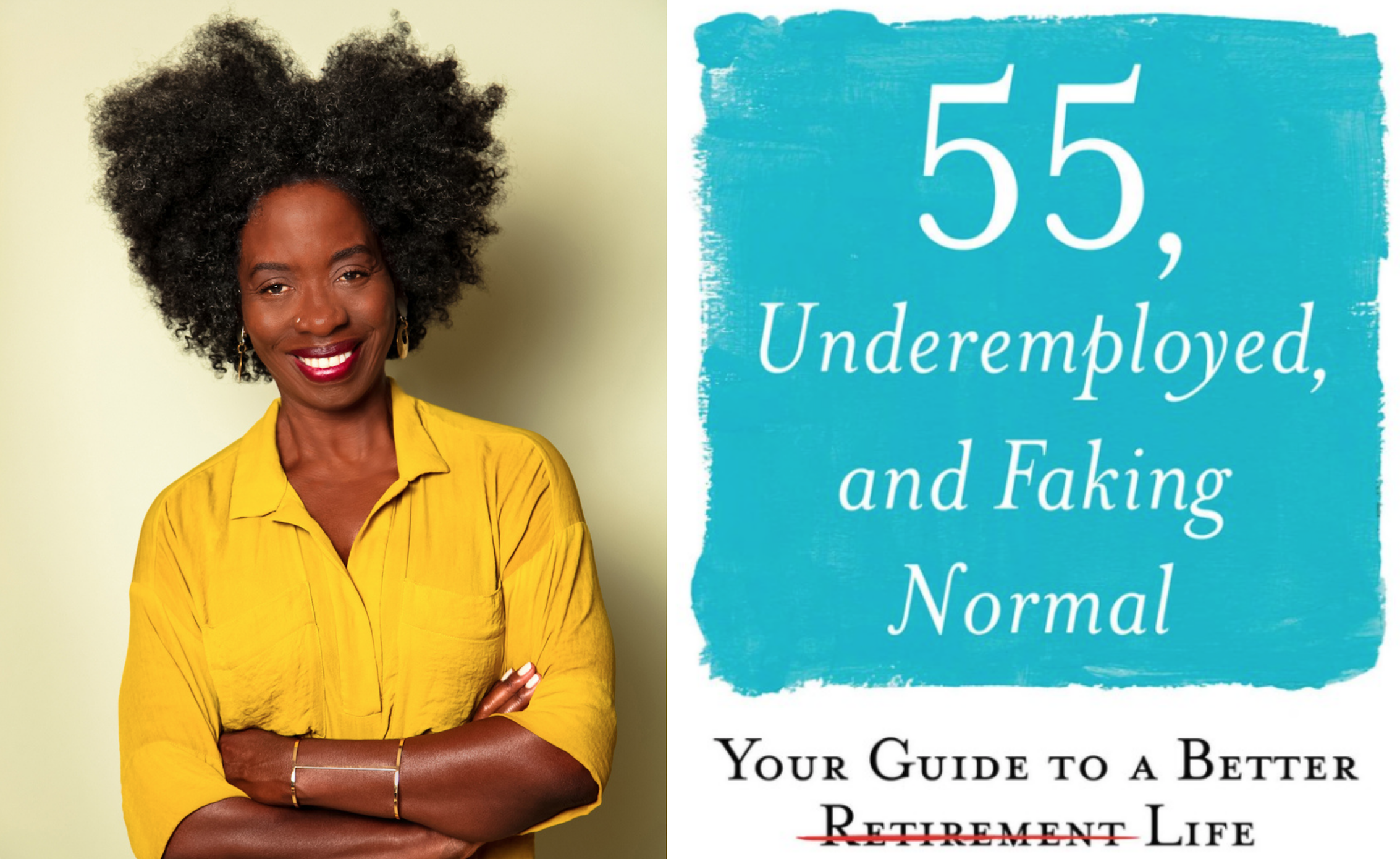

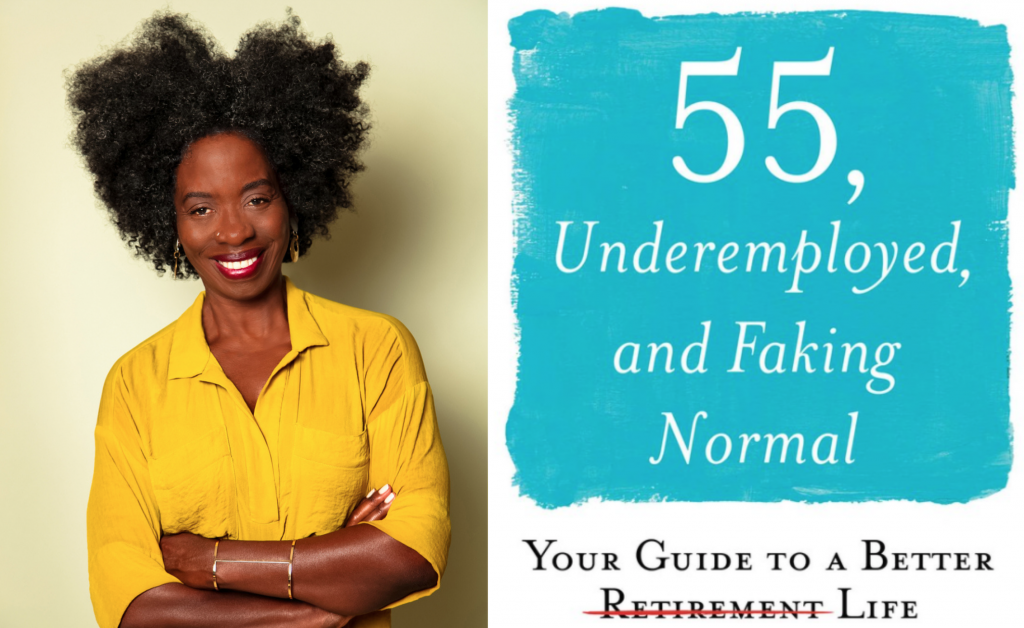

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”

Play the Long Game

Play the Long Game

Automation is your money’s best friend. By automating your finances, you reduce your opportunities for decision making, thereby reducing your chances to change your mind about saving money or paying a bill in full. By reducing your decisions you set yourself up for success! Automation can build up your savings and pay off your bills, without any extra effort on your part. So, how can you use automation as a financial tool?

Automation is your money’s best friend. By automating your finances, you reduce your opportunities for decision making, thereby reducing your chances to change your mind about saving money or paying a bill in full. By reducing your decisions you set yourself up for success! Automation can build up your savings and pay off your bills, without any extra effort on your part. So, how can you use automation as a financial tool? The other major arena of your finances that definitely deserves some automation-attention is your savings. I touched briefly on automating your savings in an earlier article,

The other major arena of your finances that definitely deserves some automation-attention is your savings. I touched briefly on automating your savings in an earlier article,