3 Ways to Prep Your Finances for the Holidays

The holiday season is a time of meaning, gathering, and giving. There are a couple key money moves you can make early on to make sure that’s the focus, instead of financial stress. Let’s talk about a couple different financial situations many of us face at this time of year, and how to navigate them peacefully!

What Do You Love Most About the Holidays?

When getting ready to make any financial decision, it’s important to check in with your values. Setting up your holiday spending plan is no exception. Take a moment and ask yourself these questions:

- What do I love most about the holidays?

- What are my needs and wants for this holiday season?

- What do I want to make sure I do to enjoy this time of year?

These questions will help you get clear on your financial priorities for holiday spending. Pick a few special things, like donating to a cause you care about, taking your family for a sleigh ride, or getting a perfect gift for someone you love.

Then orient your spending plan so that those things happen, and don’t worry about missing out on the rest. As long as you get to do what’s meaningful to you, you’ve spent your money wisely, right? Going through this process will lead to more life satisfaction and less financial stress when you find it easy to pay your credit card bill come January.

Intentional Giving

Speaking of donating, at this time of year all of us are getting requests to donate to various causes. Keep in mind that you get to be intentional about how you donate. You don’t have to respond to every single request.

Again, this is a great moment to check in with your values and ask, what causes matter most to me? Where would I like to focus my donations to make an impact?

Then, identify how much money you have available to donate, and divvy it up according to your priorities. You might choose to make one large gift to a single organization, or spread your money around between several.

Use Money Tools

Both of the processes I have outlined above can be streamlined by using money tools and systems. If you haven’t yet, I highly recommend going through a process of figuring out what you value most in life and discerning your needs from your wants. I also recommend checking out my series on creating a spending plan and my article, “How to Make Donating Money Way Easier On Your Finances.”All of these money tools can be a huge help to navigate any financial situation, any time of the year!

If you enjoyed this article and want to go through this process with a guide, I offer personal financial coaching sessions for just this purpose. Click here or below to book a free 15-minute Financial Self Care Consultation to see if we can work together to address your needs.

File Your Taxes On-Time!

File Your Taxes On-Time!

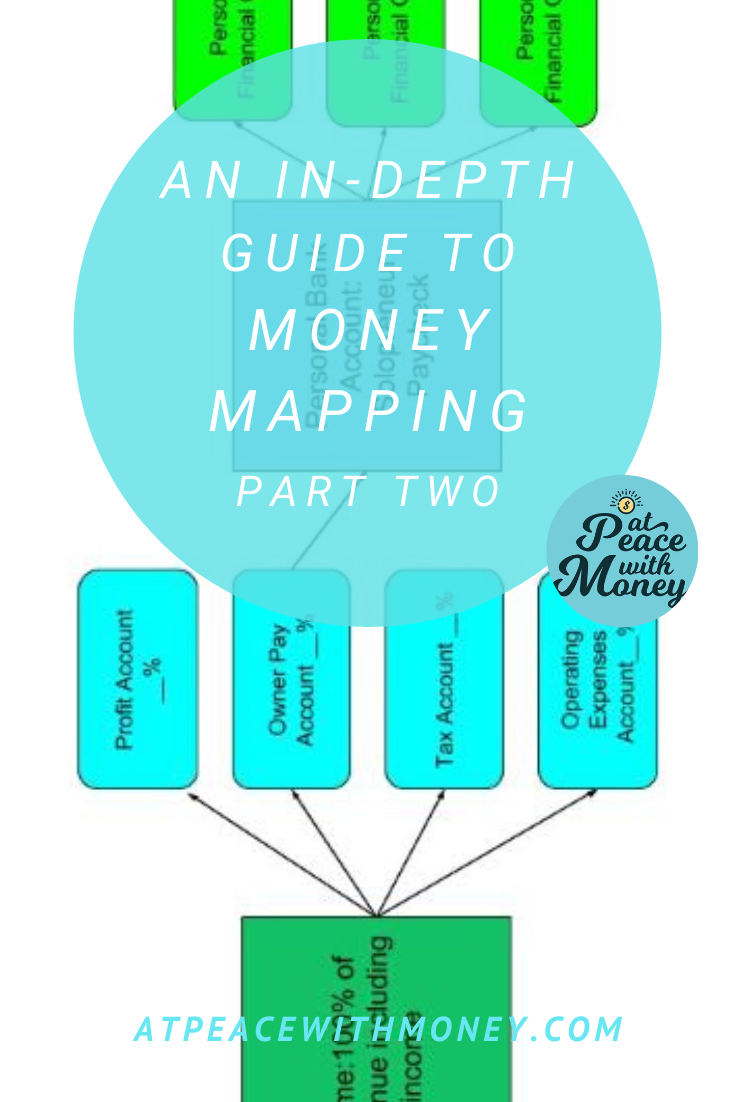

The Function of Profit

The Function of Profit

I use the hashtag #PayYourselfFirst all the time, but what does it really mean to pay yourself first? It’s a core aspect of Profit First philosophy. It’s also an important part of how I organize my own personal finances. I want to make sure all my readers know how to pay themselves first, in their business and personal finances, so let’s dive in.

I use the hashtag #PayYourselfFirst all the time, but what does it really mean to pay yourself first? It’s a core aspect of Profit First philosophy. It’s also an important part of how I organize my own personal finances. I want to make sure all my readers know how to pay themselves first, in their business and personal finances, so let’s dive in.

Recently I’ve received some questions about financial advice for young people. I think the most important piece of advice I can give is this: save your money. It’s simple, but it can be difficult to get in the saving habit. That’s why I recommend developing

Recently I’ve received some questions about financial advice for young people. I think the most important piece of advice I can give is this: save your money. It’s simple, but it can be difficult to get in the saving habit. That’s why I recommend developing  Saving is the best piece of financial advice I can give to young people. Getting in the habit of saving your money opens up a lot of choices, something that’s important and helpful in any young person’s life!

Saving is the best piece of financial advice I can give to young people. Getting in the habit of saving your money opens up a lot of choices, something that’s important and helpful in any young person’s life!