Roundup: At Peace With Money’s Best Educational Posts to Level Up Your Financial Learning

This week, please enjoy a roundup of some of my best educational posts yet. I’m getting close to my two-year blogging anniversary! In that time I’ve written up quite a few how-to’s, exercises, and perspective pieces on handling money. Below, I’ve pulled out some of my favorites, in the categories of business finance and personal finance. I’m recommending these articles in particular because they contain foundational info that informs my practice as a profitability coach. The tips and perspectives that I blog about here are tried and true. I share them because they make a huge difference to my clients, just as I hope they’ll make a difference for you! If you’re looking to kick your financial learning into high-gear, let these resources be your guides:

Personal Finance Articles

- Creating a Spending Plan

- A Guide to Saving

- Money and Marriage

- Financial Advice: How to Avoid the Bad and Find the Good

- Establishing Good Financial Habits

- Why You Need a Money Buddy

Business Finance Articles

- What’s Your Money Why?

- The In-Depth Guide to Money Mapping and How it Can Fortify Your Business, Part I, Part II, and Part III

- All About Oversaving, and Why Overcoming It Can Strengthen Your Business

- My series on financial self care for business owners: Working on Your Finances is Self Care, Why You Need to Separate Your Business and Personal Finances, Know What Your Numbers Are Telling You, and How to Set Informed Income Goals

- Getting Health Insurance If You’re a Solopreneur

- 5 Steps to Get Ready for Tax Time

- How to Build Your Best Money Team

- How to Focus Your Offerings to Create More Revenue

Suggested Readings – My Favorite Financial Books

- My series on Secrets of Six Figure Women by Barbara Stanny: What’s Your Money Mindset?, To Increase Your Earnings Take Action, Put Your Money to Work For You, and Claim Your Power

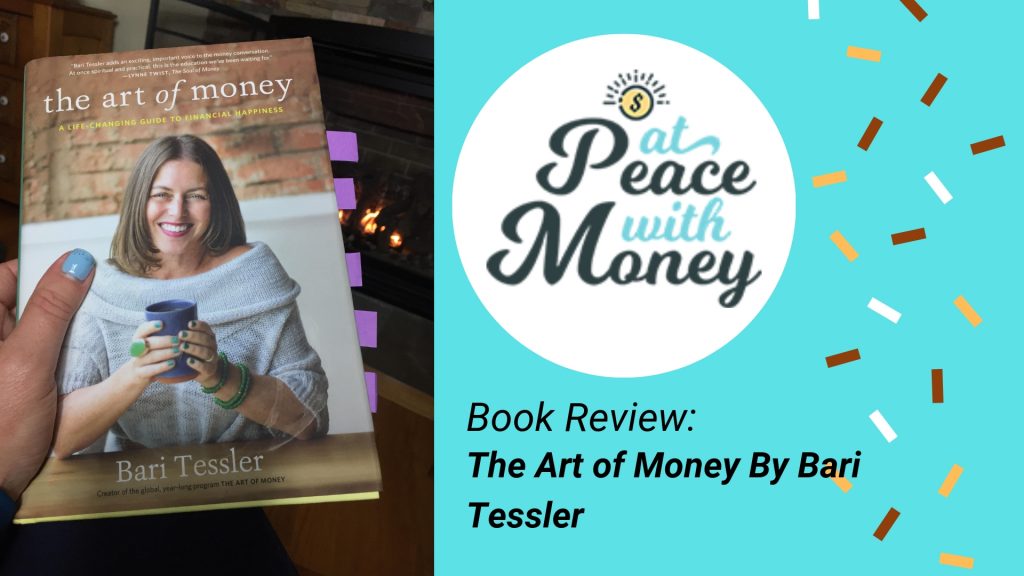

- Book Review: The Art of Money by Bari Tessler

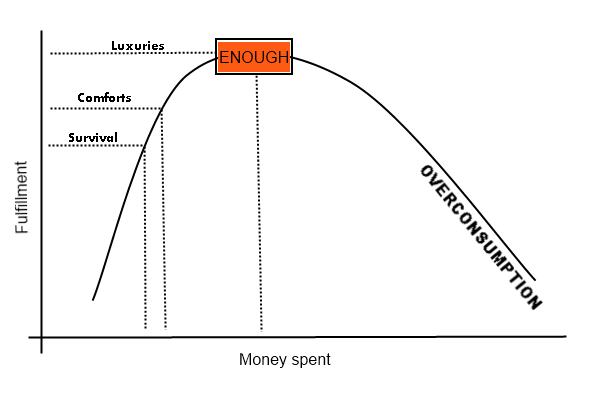

- Book Review: Your Money or Your Life by Vicki Robin and Joe Dominguez

- Book Review: Proposals for the Feminine Economy by Jennifer Armbrust

I hope these posts are helpful for you! I find that the practice of writing a blog has been a great practice in building up an archive of knowledge – one that I hope is just as helpful for you as it is for my clients.

Angela

If a resource ticks all these boxes for you, it will probably set you down the path to financial wellbeing! And it will feel a lot better than trying to read something that just isn’t for you. Next time, we’ll talk about starting the search for resources. For now, feel free to do some good ol’ googling. You can also check out my article on

If a resource ticks all these boxes for you, it will probably set you down the path to financial wellbeing! And it will feel a lot better than trying to read something that just isn’t for you. Next time, we’ll talk about starting the search for resources. For now, feel free to do some good ol’ googling. You can also check out my article on

Now it’s time to find some good resources that meet your criteria. Some googling might help with this, but you can also check out my post on

Now it’s time to find some good resources that meet your criteria. Some googling might help with this, but you can also check out my post on

afternoon off, a fun or inspiring event, or whatever you’d like to do to celebrate your achievements so far! Being a self-starting solopreneur is hard work. If you’ve done the work, you deserve to cheer yourself on once in a while.

afternoon off, a fun or inspiring event, or whatever you’d like to do to celebrate your achievements so far! Being a self-starting solopreneur is hard work. If you’ve done the work, you deserve to cheer yourself on once in a while.

When you’re making your plan, be sure to adapt your goals to what’s worked so far this year. If you really love a certain routine or feel fired up to keep working toward a certain goal, go for it. If you’ve stalled on a project because you need to do more research, carve out some time to go back to the drawing board. When charting your course, keep your own needs and preferences in mind.

When you’re making your plan, be sure to adapt your goals to what’s worked so far this year. If you really love a certain routine or feel fired up to keep working toward a certain goal, go for it. If you’ve stalled on a project because you need to do more research, carve out some time to go back to the drawing board. When charting your course, keep your own needs and preferences in mind.

Finally, I want to add a note about the need for diversification. Any professional will tell you that it’s important not to put all your eggs in one basket.

Finally, I want to add a note about the need for diversification. Any professional will tell you that it’s important not to put all your eggs in one basket.

Further Reading

Further Reading

Her final phase deals with goals, dreams and plans. Her philosophy holds that when you have healed your relationship with money and have tools in place to address it, you can start to see the bigger picture and how your dreams can become reality. This book can be a great resource, but particularly if you have money beliefs or blocks that are holding you back. It provides support and practical tools to heal and move forward with improved financial self care. My posts this month will feature other ideas and support around this topic. If you are ready for more in-depth help around your money systems, I invite you to

Her final phase deals with goals, dreams and plans. Her philosophy holds that when you have healed your relationship with money and have tools in place to address it, you can start to see the bigger picture and how your dreams can become reality. This book can be a great resource, but particularly if you have money beliefs or blocks that are holding you back. It provides support and practical tools to heal and move forward with improved financial self care. My posts this month will feature other ideas and support around this topic. If you are ready for more in-depth help around your money systems, I invite you to

we don’t need to stew and feel bad about them. The best thing we can do is move on and take action to enhance our financial futures. This mantra helps us remember that instead of being distracted by our past mistakes, we should look forward and act now.

we don’t need to stew and feel bad about them. The best thing we can do is move on and take action to enhance our financial futures. This mantra helps us remember that instead of being distracted by our past mistakes, we should look forward and act now.