Your Ultimate Small-Business Spending Decision Tree

As a small business owner, you have to make a lot of decisions. Most of them are pretty important. Your spending decisions are no different. Especially when you’re getting started or working with a small budget, it’s important to view your business spending decisions as investments. These investments influence the value you offer your customers, and the overall success of your business.

One of the biggest worries I frequently hear from the small business owners I work with is about their spending decisions. Whether they’re concerned they overspending on the wrong things, oversaving and not investing enough, or spending at the wrong time, it all boils down to concerns over spending.

To help diffuse these worries, I’ve created this decision tree to help you make business spending decisions. Turn to it when you need some guidance or are faced with an important decision. Even if this guide doesn’t walk you through everything you may want to consider when making a spending decision, it’s a good resource to get you started!

Keep Your Expenses Low

Let’s start off this guide with a note about where this perspective is coming from. From all my experiences working with solopreneurs and small business owners, I personally can say I believe it’s almost always advantageous to keep overall business expenses low whenever possible. The lower you keep your business expenses, the closer you get to creating a supportive and financially sustainable business.

Speaking of sustainability I also believe that incremental change is better than radical change and incurring a bunch of expenses all at once. Even if a certain expense doesn’t make sense for you right now, you can always make a new decision or scale up in the future.

What needs have I identified in my business that will be satisfied by this investment? Is this solution the best fit for my business?

Ask yourself: Is there another product/service/offering that is lower cost that could still satisfy my business needs? If you’re not sure, consider doing a bit more research before proceeding.

Have I had any experience with this solution, direct or indirect? Was it satisfactory?

For example, perhaps you’re wanting to invest in some scheduling software. Maybe you’ve had an opportunity to try a free trial or have spoken to a colleague who uses the same software. Consider what you know from this experience and whether the software would be best for your needs. If the answer is yes, move forward.

Remember not to be a perfectionist here, though! You can always change your mind and make a different decision later, and there’s no harm in trying something out. The goal of these questions is help you make balanced decisions.

Can I afford this expense?

If you’re not sure, take a quick look at your cash on hand. (This is something you can do regularly in a weekly money check-in to stay on top of your business finances.) Refer to your business spending plan for the month and any plans you have for business savings you might have.

Taking all of this into account, can you afford to make this investment right now? And if not, how are you planning to finance it? How quickly will you be able to pay that financing off? Make sure you are comfortable with these spending arrangements and that they make sense for your business before proceeding.

Do I have a reasonable expectation of seeing a return on my investment either financially or in my own personal growth or capacity?

These questions are last, but definitely not least! It’s important to essentially ask yourself with any business expense you’re considering, “Will this help me make more money?”. If the answer is no, this is a good place to stop and reconsider. If your goal is to run a profitable business, then financial concerns need to be considered as a top priority.

If you’re not sure, think about how this expense will affect your work life. If, for example, it’s an investment that will save you time and allow you to do more of the income-generating tasks related to your business, then this could be a great investment. Consider how much time it will save you and try to quantify that when thinking about what your return on this investment will be.

To consider the second part of the question, refer back to your values. Ask yourself, will this investment bring more of what I value into my work and life? It can be difficult to quantify how much money something like this might be worth to you, which is why it’s important to consider your answer to this question alongside your answers to all the others in this guide.

Special Note About Impostor Syndrome and Spending on Education/Training

Especially when it comes to spending on things like trainings and certifications, many small business owners, and particularly women, sell themselves short when it comes to their own expertise and feel like they “need” more training. This same phenomenon can also apply to branding. Some business owners can spend themselves into a hole trying to make sure their business branding looks professional.

This spending behavior often stems from an emotional root of not feeling good enough, commonly referred to as impostor syndrome. If this is something you know you struggle with, I encourage you to refer to a couple more resources along with this guide when making spending decisions. Here’s a great decision tree shared by business consultant Shaneh F. Woods, and my article “Don’t Let Impostor Syndrome Fuel Overspending in Your Business.”

Both of these will get you started off in a right direction. Perhaps you’ll find that you can make your own decision tree to encourage yourself to make balanced spending decisions!

If you enjoyed this article, then I bet you’ll love my free E-Book, “Reach Your Life Goals: A Business Owner’s Guide.” Click here or below to download your free copy.

File Your Taxes On-Time!

File Your Taxes On-Time!

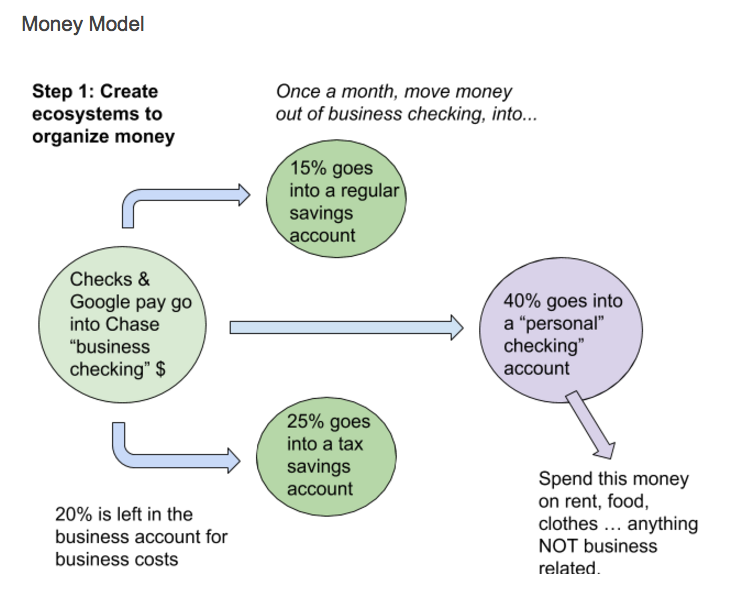

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.

or for expansion. You can read more about the

or for expansion. You can read more about the

create a financially streamlined business. Strategizing to prepare for surprise expenses and taxes, offer more of your most profitable products or services at the optimal time of year, and remembering to pay yourself all contribute to financial success. If you’re interested in doing this analysis work with some professional help, I’m happy to speak with you. Take a look at

create a financially streamlined business. Strategizing to prepare for surprise expenses and taxes, offer more of your most profitable products or services at the optimal time of year, and remembering to pay yourself all contribute to financial success. If you’re interested in doing this analysis work with some professional help, I’m happy to speak with you. Take a look at

Recognizing this may mean we need to reexamine our approach with expenses in general. When making a purchase, it’s important to a

Recognizing this may mean we need to reexamine our approach with expenses in general. When making a purchase, it’s important to a