Book Review: It’s Not Your Money by Tosha Silver

I’m curious, what feelings come up for you when you read the title of Tosha Silver’s book, It’s Not Your Money? Do you scoff or disapprove? Are you intrigued? Perhaps something else entirely comes up for you, or a mix of both. Today’s book review is focusing on a book that deals with a popular topic on this blog: money mindset.

However, Tosha Silver’s background is not as a money coach or bookkeeper (like myself). Her works originated from her love for and desire to share yogic philosophy. Her unique background gives this book a powerful spiritual charge. This book was an excellent and insightful read. Here are my top three takeaways:

#1: We’re Not In Charge

The title of this book is central to its philosophy. Throughout, Tosha tries to communicate that we alone are not in charge of what happens. She encourages the reader to “release doership,” embrace surrender, and give everything over to Love. Specifically, she speaks of Divine Love, her vision of a higher power. She suggest surrendering over to this power.

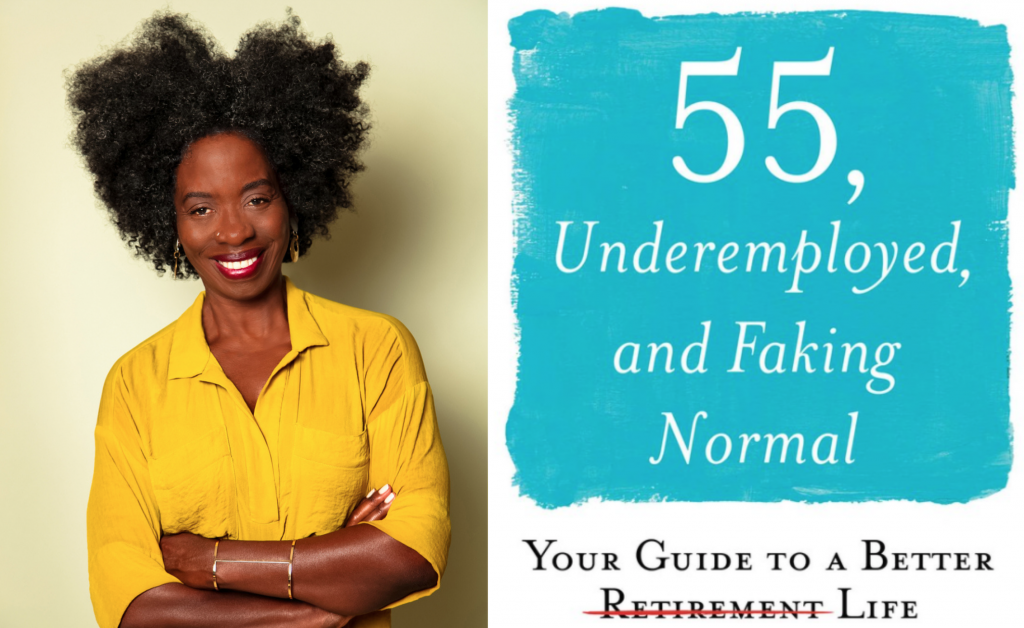

Now, if you’re reading this and raising your eyebrows, I get it. Surrender is nice and all, but applying it to your money in our competitive and driven world is no small feat. However, this book makes a wonderful case and provides a clear framework for doing just that. Much like Lyne Twist’s The Soul of Money, this book encourages us to see money like water – just a part of the flow in the universe.

This piece of the book was interesting for me to read. It reminded me of some other money mindset work that I have read and written about, which emphasizes the importance of releasing financial anxiety and other money baggage. Surrendering the care of our money and our wellbeing over to Divine Love is also, probably not coincidentally, a great way to release financial anxiety.

#2: Language Matters

During the book, Tosha outlines a 5 step process. One of these places great emphasis on the language we use around money. Specifically, she encourages us to examine the language we use around our financial situations. Another piece of this process also delves into working with prayers and affirmations. She introduces “Change Me Prayers,” which are meant to help the reader give up who they used to be to the Divine, in order to allow for change. Here’s one of these prayers below:

“Change me, Divine Beloved, into one who fully trusts that all true needs are always met through your bounty. Let me surrender and allow You to be my Source for All. Let me breathe, relax, and let you lead. I am safe. I am peaceful. All needs will abundantly be met. I am Yours completely.”

Isn’t that prayer beautiful? Definitely not your typical money mindset work! As a fellow lover of affirmations and an appreciator of words, I deeply resonated with these elements of her approach.

#3: Make Space

Another piece of this 5-step process is decluttering. Tosha invites the reader to “let what needs to go, go, so that what needs to come, can come.” This is an exercise in detachment, another theme running throughout the book. She writes, “Detachment is not that should own nothing, but that nothing should own you.”

As a Marie Kondo fan, this was not necessarily a new concept for me, but an exciting one nonetheless. In the past, I’ve talked about reviewing and refreshing your finances occasionally. The idea of incorporating an emphasis on decluttering and detachment is exciting and something I just might try out!

In sum, this book was an excellent book about money mindset work with a deep spiritual emphasis. I’d recommend this book not only for folks interested in money, but also for those less interested, too! The spiritual emphasis makes it inviting for those who tend to eschew material focus.

If you enjoyed this book review, you’ll probably like being on my newsletter! Click here to subscribe and receive my monthly tailored newsletter full of important financial conversations, and my weekly blog updates.

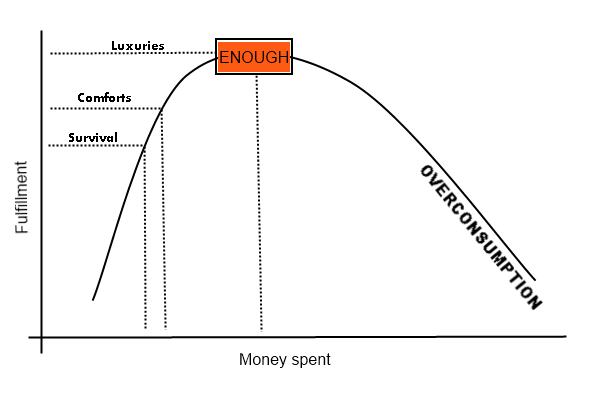

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”

Lastly, I very much enjoy her thoughts about cultivating an abundance consciousness. Again, it is easy to define abundance through numbers when thinking about businesses, and particularly for me as a profitability coach. She reminds us to “feel how rich you are already” and to remember that “money isn’t the only form of wealth”. These are the lessons I try to remember when I define the success of my business and the success I am helping my clients to experience. I highly recommend checking out

Lastly, I very much enjoy her thoughts about cultivating an abundance consciousness. Again, it is easy to define abundance through numbers when thinking about businesses, and particularly for me as a profitability coach. She reminds us to “feel how rich you are already” and to remember that “money isn’t the only form of wealth”. These are the lessons I try to remember when I define the success of my business and the success I am helping my clients to experience. I highly recommend checking out

Three Keys

Three Keys

The path to making this mindset shift towards abundance includes gratitude, affirmations about your worth, and a decision to make a change.

The path to making this mindset shift towards abundance includes gratitude, affirmations about your worth, and a decision to make a change.

brings me joy. Expect chapter titles like Abundance, Harmony, and Magic! Each chapter includes an overview and the science behind these aesthetics of joy. Then, she articulates easily attainable ideas and examples to bring in more of each element.

brings me joy. Expect chapter titles like Abundance, Harmony, and Magic! Each chapter includes an overview and the science behind these aesthetics of joy. Then, she articulates easily attainable ideas and examples to bring in more of each element.

Her final phase deals with goals, dreams and plans. Her philosophy holds that when you have healed your relationship with money and have tools in place to address it, you can start to see the bigger picture and how your dreams can become reality. This book can be a great resource, but particularly if you have money beliefs or blocks that are holding you back. It provides support and practical tools to heal and move forward with improved financial self care. My posts this month will feature other ideas and support around this topic. If you are ready for more in-depth help around your money systems, I invite you to

Her final phase deals with goals, dreams and plans. Her philosophy holds that when you have healed your relationship with money and have tools in place to address it, you can start to see the bigger picture and how your dreams can become reality. This book can be a great resource, but particularly if you have money beliefs or blocks that are holding you back. It provides support and practical tools to heal and move forward with improved financial self care. My posts this month will feature other ideas and support around this topic. If you are ready for more in-depth help around your money systems, I invite you to

we don’t need to stew and feel bad about them. The best thing we can do is move on and take action to enhance our financial futures. This mantra helps us remember that instead of being distracted by our past mistakes, we should look forward and act now.

we don’t need to stew and feel bad about them. The best thing we can do is move on and take action to enhance our financial futures. This mantra helps us remember that instead of being distracted by our past mistakes, we should look forward and act now.

What’s important is getting start

What’s important is getting start